Christofer Toumazou

Serial entrepreneur and Regius Professor of medical engineering, Imperial college

Education

All Saints Secondary

Modern, Cheltenham

BSc and PhD in electrical engineering, Oxford Polytechnic

Career

1986: Joins Imperial College’s department of electrical and electronic engineering

1995: Becomes Imperial’s youngest professor

2001: Appointed head of department of bioengineering; founds Toumaz Technology

2003: Raises £22m to create Institute of Biomedical Engineering at Imperial, and

is named director and chief scientist

2004: Founds DNA Electronics; he remains chairman and CEO

2008: Elected Fellow of the Royal Society and Royal Academy of Engineering

2013: Made Regius Professor

2014: Founds GeneU, wins European Inventor Award

Commercialising technology is one of the most challenging tasks facing any researcher. How can you take your discovery from the lab bench to the big wide world where it can start to change people’s lives? How do you turn a project into a product? How can you get people to invest real money into something that not only doesn’t exist, but might not be anything like anything that currently does exist?

Chris Toumazou has managed this task not just once but three times. The Regius Professor of medical engineering at Imperial College has turned three pieces of technology into companies: vital signs monitoring sensors mounted onto ‘digital plasters’ with Toumaz Technologies; real-time disposable gene tests with DNA Electronics; and personalised skincare with GeneU.

So is there a dark art in attracting investors? Toumazou accepts that his personal standing is an important lever. ‘Having Professor before my name does help a lot with convincing people that I’m serious,’ he said. ‘Being the inventor of the technology and a professor at an institution such as Imperial gives a certain amount of comfort that, technically, there’s some element of de-risking.’

But the title alone isn’t enough, he added. ‘I always partner up with an industrialist. There is a perception that academics get attached to their technology and see it as a means to another publication or to boost their own profile, so it’s important to me that I have someone who’s not so much an astute, commercially savvy person as someone who knows the process and operational side of a technology business and has worked with medium-to-large commercial operations before.’

’If you get very early-stage money from the more traditional venture capital community then it’s my belief that the innovation bit is slightly more stifled because there are more constraints

This is particularly important for innovations that have come out of interdisciplinary research, he said. ‘There are inevitably prima donnas working together, so it’s really important to show investors that the management is there to manage these prima donnas without stifling innovation; you need someone who understands the innovation but also the nuts and bolts of business execution. They’re a rare breed but they do exist.’

Toumazou said that universities are increasingly finding such people themselves; he set up Toumaz Technologies with the help of Oxford Brookes University’s entrepreneur-in-residence, Keith Errey. ‘The academic is likely to be the evangelist or ambassador for the technology and its best salesman, but you do need that sort of person who’s been through the system.’

The next question is, who to approach? Toumazou doesn’t favour going directly to corporate venture capital. He’s had more success going with ‘angel’ investors who put in relatively small sums at an early stage. ‘One thing that attracts investors is that my technologies are healthcare oriented and, more importantly, most of the IP that comes out of my group is multidisciplinary so there’s something a bit more adventurous about it,’ he said.

Toumazou added that he tends to meet people such as this at conferences and similar events. ‘It’s interesting that the people I get this early stage investment from haven’t been involved strategically in this industry; they might have made money in the stock market or a chain of supermarkets but now they’ve made their money they want to dabble in something exciting.’ What’s especially important is that these investors are used to financial risk but are prepared to be hands-off at the outset, and this is a major difference to how venture capital often works. ‘If you get very early-stage money from the more traditional venture capital community then it’s my belief that the innovation bit is slightly more stifled because there are more constraints; I’ve witnessed this. You don’t get that when you have angel pump-priming, which allows you to then move on to the corporate venture capitals.’

It could be said that this is like the TV series Dragons’ Den, but in a version where the inventor gets to pick the dragons: an analogy which Toumazou finds appealing. ‘That investment, where you’re not looking for tens of millions of pounds, but maybe a million per investor, gets me to the point where something that was initially opportunistic is more strategic to them; and the fact that you’ve attracted pump-priming makes it more attractive because someone else has had the confidence to put money in already.’

’It’s so difficult to evaluate the business model for something that could change things so completely.

That means that the conventional venture capital investment comes in at a point where the technology is not just R&D, but it’s already edging towards proof of concept and the evaluation of the business is higher.

‘That’s very important for disruptive technologies, because it’s so difficult to evaluate the business model for something that could change things so completely. Who would have guessed seven or eight years ago that we could have a digital patch, a plaster stuck on someone’s chest that relayed vital signs 24-7 or that you could get DNA test results within half an hour that would tell you how well someone would respond to drugs? You almost have to build your own business model as you go and nobody’s geared up to assess it because it doesn’t exist, and it’s possible that there isn’t even an analogy to it. That’s why it can be so high risk, but if it does pay off, the potential market is enormous.’

Once venture capital does come in, Toumazou takes a back seat. ‘That’s where my involvement becomes very technical and you bring in the seasoned CEO to run the business. That’s why it’s very valuable to have someone to fill that role waiting in the wings at the outset. Toumazou tends to remain on the board of his spin-outs in the role of technical director. ‘I’m at that stage now with DNA Electronics,’ he added.

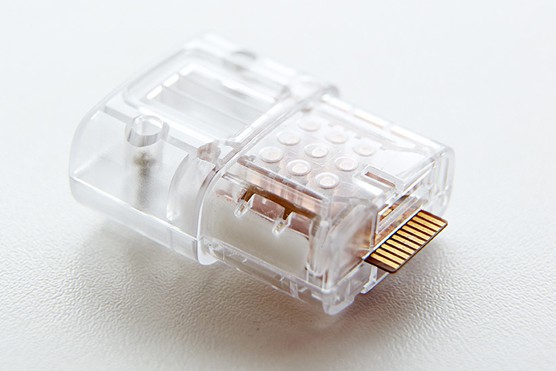

GeneU Skincare, Toumazou’s latest venture, is a cosmetics company that uses his USB stick-based DNA test to determine which of a library of active ingredients will have the best effect on a patient’s skin. ‘We’ll take a DNA sample from a cheek swab, run it through the test and we’ll be able to send a client away with a set of products that are tailored so that they’ll have the desired effect,’ he explained. ‘Part of the idea is to de-mystify medical technologies, because to a large extent people just aren’t used to them, but they’re going to play such an important role in people’s lives in the near future.’

Toumazou is chairman and chief scientific officer of GeneU, while the creative director is Nick Rhodes, keyboard player of Duran Duran and a living example of the benefits of skincare. The company is opening its flagship store on Bond Street, London, this month.

Meanwhile, Toumazou’s next spin-out is likely to be based on technology currently in trials for Type 1 diabetes, which uses implanted sensors to measure blood-sugar levels in real time and adjust constant insulin dosage from a pump. In effect, this is an artificial pancreas, and addresses Toumazou’s concerns about treatment of chronic disease. ‘When my son was diagnosed with a kidney disease I realised just how primitive chronic disease management was,’ he said. ‘That was really hard as parents; to apply technology in a home setting that was in fact state of the art but seemed so primitive; and I was thinking: “We’ve got genome technology, we’ve got wireless technology, we have non-obtrusive therapies, why are we using all this… antiquated stuff?”’

Toumazou is determined to bring the sophistication of the commercial electronics in telecoms and computing to bear onto the medical field, and to enlist the help of the finance sector to do it.

Project to investigate hybrid approach to titanium manufacturing

What is this a hybrid of? Superplastic forming tends to be performed slowly as otherwise the behaviour is the hot creep that typifies hot...