The UK was the world’s first nuclear-powered nation, with the first grid-connected nuclear reactor, Calder Hall, coming on stream in 1956. At the forefront of nuclear technologies for several decades, the country stepped back somewhat from nuclear with changes in government policy, public attitudes, and costs. And following the privatisation of the energy industry in the 1980s and 1990s, R&D spending dropped away, and with it the UK’s capability to build nuclear power stations.

Now, as we teeter ever closer to the start of the programme to build new nuclear power stations in the UK, it seems inevitable that most of the dozen reactors on the planning slate will be made overseas. The declared players in the new-build arena — EDF and Horizon Nuclear Power — are set to build European Pressurised Reactors (EPRs) at Hinkley Point in Somerset and Sizewell in Suffolk; the major components for these will come from the facilities of Areva, like EDF owned mostly by the French state, in southern France (see box). Horizon, owned by Hitachi, is planning Advanced Boiling Water Reactors (ABWRs) at Oldbury in Gloucestershire and Wylfa in Anglesey; while the company has stated that it wishes to establish a UK supply chain for a proportion of the manufacture, the mighty presses of the Japan Steelworks on the island of Hokkaido are likely to be involved.

But the UK Technology Strategy Board (TSB) maintains a nuclear industry strategy to foster development of nuclear manufacturing capability in the UK, last year investing some £18m in co-funded projects worth a total of £31m. Is the UK on its way back as a nuclear manufacturing centre? And if so, where will this newly built manufacturing capability slot into the picture of global nuclear power station building?

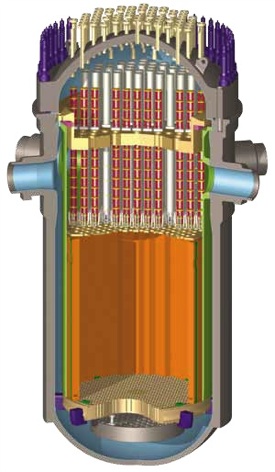

Nuclear is one of the heaviest of the heavy engineering sectors, requiring enormous components: towering structures weighing thousands of tonnes, made from metal many inches in thickness, but highly engineered, with tolerances down to fractions of millimetres; and some unexpectedly delicate sub-components. Devices to measure neutron flux inside a reactor, for example, work by blowing tiny spheres of metal along narrow tubes set among the fuel elements; thermocouples and pressure sensors are also extremely small. But relatively few power stations are being built at any one time, and the huge factories capable of building the major components for the light water reactors that dominate the market — reactor vessels, steam generators and pressurisers — are more than capable of scheduling in the UK’s demands.

“We can make pretty much everything they can make at [Areva’s forging site] Le Creusot

Peter Birtles, Sheffield Forgemasters

For Sheffield Forgemasters, probably Britain’s premier expert at handling huge lumps of steel, the manufacturing factor was probably a deciding one for EDF and Horizon. ‘We can make pretty much everything they can make at [Areva’s forging site] Le Creusot,’ said Forgemasters’ director and former managing director, Peter Birtles. ‘That means about 70 per cent of the main forged components for the nuclear island and most of the castings. The remaining 30 per cent can’t be made in Europe at all — Areva and Westinghouse both have to go to Japan Steelworks for those, because it is one of the only facilities with the size of ingot and the size of forging press, and probably the only one with the nuclear qualifications and reputation for integrity to be acceptable.’

So the choice of EDF and Hitachi to buy into the UK nuclear sector was a political one, Birtles said. ‘EDF is largely owned by the French government, and it bought into the UK nuclear programme primarily so that Areva — which is also government owned — could make components for the UK. Similarly, if Horizon had gone with Westinghouse for its reactors, it would have opened up opportunities for the UK, but Hitachi bought the business primarily, we believe, to provide work for the Japanese forging industry.’

Hitachi, as it happens, has a somewhat different take. ‘We believe that up to 60 per cent of our projects could be sourced from within the UK,’ said Morgan Powell, Head of Commercial at Horizon Nuclear Power. ‘Horizon is developing our projects on an engineering, procurement and construction (EPC) basis. Around 85-90 per cent of project scope will be delivered by Hitachi-GE Nuclear Energy (HGNE), with Horizon overseeing as the intelligent customer. Of course, substantial elements of work will remain within owners scope, but HGNE will be our delivery team leader. Work packages will then flow out through the supply chain, down the tiers to the most appropriate level. In terms of construction, Hitachi has stated an intent to develop a module construction facility in the UK for these projects, and this is a real opportunity for the British market. Naturally there will be an international aspect to our supply chain, with some components coming from abroad, but there will still be really significant opportunities for the UK. As our plans develop further, we’ll continue to share our latest understanding with the supply chain.’

For the TSB, the near-future opportunities for nuclear manufacturing in the UK lie not so much in building the plants, but in maintaining the existing ones. ‘We’re looking at operations, maintenance and decommissioning,’ said TSB head of energy, Rob Saunders. ‘Some of our projects are looking at robotics, some are looking at advanced pump design, some at engineering the systems outside the reactor systems, including life extension.’

“Hitachi has stated an intent to develop a module construction facility in the UK, and this is a real opportunity for the British market

Morgan Powell, Horizon Nuclear Power

At the centre of UK nuclear manufacturing development is the Nuclear Advanced Manufacturing Research Centre (AMRC) at Sheffield University. Part of the TSB’s High-Value Manufacturing Catapult, the AMRC handles projects between technology readiness levels three (experimental proof of concept) to seven (confirmed capability for production). Its projects range from optimisation of machine tools for applications such as deep drilling or working on very large assemblies without the need for gantries, to virtual manufacturing, testing and assembly.

Much of this work, as Forgemasters’ Birtles explained, is aimed at other reactors than the 12 already proposed. ‘We’re going to need a very large expansion in generating capacity,’ he said. ‘The UK’s carbon emissions commitments mean that, unless there are large leaps made in wind turbines and marine power technologies, a lot of it is likely to be nuclear. There’s been a large amount of interest in small, modular reactors, mainly for developing economies, but they would also be suitable for the UK,

and they are smaller and cheaper to build.’

In developing reactors such as these, new techniques might be needed — and for this, Birtles said, there is a large opportunity for the UK. ‘There’s actually a lot of parallels between building gas turbines for aero engines — which the UK is very good at — and making nuclear reactors,’ he said. ‘They are highly engineered and massively risk-averse — you cannot put in equipment that might fail. The aerospace industry has made great strides in advanced computing, so that rather than only make small incremental advances, which is very slow, you can develop much more radical designs, test them in simulation and have a high degree of confidence in the components, materials and manufacturing methods.’

The UK nuclear sector is working towards the same goal, he explained. ‘If you look at the large components, they are made using very old techniques. You have an enormous block of metal forged from an even bigger ingot, which is pretty rough and ready, and that’s put on a machine tool and the actual component — say, a channel head for a steam generator, which is hemispherical and has several protruding nozzles — is carved out of it. It’s totally unnecessary. We’ve already shown for Rolls-Royce, for whom we forge all the components for submarine reactors, and for Westinghouse that you can forge a large flat disc, form that over complex tools under the press to give you a hemisphere, do a bit

of machining then put it back in the press and extrude the nozzles using different forging techniques. The result is the same component, with no welds that introduce stresses into the metal, but at a better quality because the grain flow of the metal follows the profile of the finished part, and you need much less metal and a smaller forging press.’

But this is a radically different technique, Birtles admits. ‘One of the things we’re doing with a TSB grant is to develop modelling techniques alongside our prototyping to prove the correlation between the two. Then we can use analysis techniques to give confidence to builders and designers that these radical new technologies are safe.’

Such techniques may not be utilised in the short term, he said. ‘They aren’t implemented on current nuclear submarines, but they might be on the next ones — and that’ll be an important step towards civil qualification. And they won’t be on Westinghouse AP1000s or EPRs, but they could be tried out in India or China. It’s not a five-minute job,’ he continued, ‘but by the time we get it proven, it’ll give us a big advantage over the rest of the world — and we’re seeing nuclear expansion everywhere.’

French lessons: Inside Areva’s nuclear production facilities

In a huge room in Bordeaux, hangar-like and cool as a cavern, lie four sleeping giants. The size of train carriages, 24m along their long axis and each weighing more than 500 tonnes, they rest on specially constructed beds, high above the floor. They will soon begin a journey that will take them south, downriver to the sea, where they will sail past Cape Trafalgar, around the coast of Portugal and the Bay of Biscay, to Normandy. There, they will be hoisted upright and fixed into place inside the main reactor building at Flamanville II, the European Pressurised Reactor (EPR) nuclear power station being built by Areva for utility company EDF. Once in place, they will receive the hot, pressurised solution of boron salts that cools the reactor and transfer its heat to a separate circuit of water, generating steam to spin the station’s turbines and transform the energy of nuclear fission into electricity.

The four steam generators, coated in a translucent white varnish to protect their steel surfaces while in transit, are being stored next door to the factory where they were made, Areva’s Chalon/Saint-Marcel facility near Le Creusot, in an area that has been a metalworking heartland since the 18th century. The factory is Areva’s large-component production centre, and assembles the parts that make up the primary coolant circuit for an EPR power station — parts where coolant comes into contact with nuclear fuel components: the reactor vessel itself, the steam generators, the pressuriser, and the main coolant pumps.

Chalon/St-Marcel is part of Areva’s technical centre network, which supports the manufacture and operation of the French company’s nuclear power stations. Although not all of the major components are made there — in the case of the two Taishan power stations in Guangdong province, components were made in China, and one particular component for the reactor vessel can only be produced at a foundry in Japan — it is the origin of the majority of components. The company expects to make the primary circuit components for its four planned UK power stations — two each at Hinkley Point and Sizewell, at Chalon/St-Marcel.

Components start their life at the nearby Le Creusot forge, which produces forgings for the heads and bodies of steam generators, reactor vessels and pressurisers. To give an idea of scale, a reactor pressure vessel is 5.4m in diameter and its walls are 30cm thick. It also makes the smaller but equally critical piping that connects them together; and casts components such as pump casings and the stainless steel liners for the reactor pressure vessels. The only component it cannot make is the upper section of the reactor pressure vessel, which includes the nozzles that take coolant into and out of the reactor; forged in a single piece to avoid having to weld parts directly onto the pressure-vessel wall, these are made at a specialist facility in Japan and shipped to France.

The components are machined at another facility and transferred to Chalon/St-Marcel for finishing and assembly. The facility also houses a development centre working on techniques such as welding; for example, pipes are currently welded onto the nozzles of the reactor vessel by fixing the unfinished vessel into a rig and revolving the whole thing through 360˚ while the welding head remains static — a new technique is currently being developed that revolves the welding head around the static nozzle instead. This seems simpler but in fact involves careful work to ensure weld integrity around the whole circumference of the nozzle, and avoiding the tendency of molten metal to drip. But this is still far away from the factory floor; it can take 15 years for a new technique to be developed, certified and adopted — this one has maybe 10 years to go.

Elsewhere at Le Creusot, a scaled mock-up of the EPR vessel is used to investigate and verify the fluid flow inside the reactor. Made entirely from transparent Perspex, the model was needed because of a major design change from previous light-water reactors: monitoring and measurement devices were previously inserted into the reactor via ports in the base of the vessel, but in the EPR they go in through the top, along with the control rods, to reduce the number of vessel penetrations. This affects coolant flow patterns, so new baffles had to be designed and tested. The transparent walls of the model allow lasers to measure the flow characteristics of water inside the vessel.

Modelling at scale is a key part of Areva’s technical and manufacturing processes. At the technical centre campus in Erlangen, Germany, a number of test loops simulate different aspects of the conditions inside a nuclear power station, many of which are used to design and verify passive cooling processes that work by gravity and natural circulation driven by heat, intended to maintain the reactor at a safe temperature for as long as possible in the case of a complete power failure rendering pumps unusable.

The most complex of these simulation rigs is PKL, a German acronym for primary coolant loop. Housed inside a tall, narrow building, PKL is a full-height model of the entire primary loop: reactor vessel, four steam generators, pressuriser and pumps. The reactor-vessel model contains full-sized fuel rods, heated in this case by electric elements rather than nuclear fission but to the same temperatures experienced inside a real reactor. The cross-sections of all the components are one-twelfth of the scale of the real things, to keep the heating energy requirements down: were the rig the exact same size as an EPR, heating it would black out the town. But as it’s the height of a liquid column that determines the pressure it exerts, the rig yields 1:1 comparison data.

The Erlangen campus also houses Areva’s hot-room labs, where materials that have been exposed to radioactivity and which are themselves radioactive are examined and tested. These facilities, like those at Le Creusot, service all of Areva’s plants around the world and would not need to be replicated for new UK plants.

Red Bull makes hydrogen fuel cell play with AVL

Formula 1 is an anachronistic anomaly where its only cutting edge is in engine development. The rules prohibit any real innovation and there would be...