So when the previous government wanted a report on how to turn more of Britain’s university research into commercial ventures, Hauser was an obvious person to write it. His recommendation was to create a series of technology centres to help small firms and university spinouts take their prototype products to market. And when the current government came to power, it took forward the idea and launched what are now known as the Catapult centres.

His view on the Catapults is that they have been a good effort so far, even if he wanted them named after a famous British scientist. But he is withholding his ultimate judgement for the same reason that he was surprised the idea was picked up by the politicians in the first place.

‘I think the important thing to realise with the Catapult centres is that we will not know how good they are for another three to five years when we’ll have early signs of whether they fulfil their purpose,’ he says. ‘And the real benefits we’ll reap probably in 10 to 20 years’ time. This was always something that was very difficult to explain to politicians about these intermediate institutions between university and industry.’

So what else can be done in the meantime to support small firms and help them get the investment they need to create the wealth and jobs that the government (and everybody else) is so desperate for? Speak to these companies and they’ll each give you a different answer as to what’s holding them back: investors’ risk averseness or technical inexperience, bureaucracy, tax, even a lack of ambition. It all sounds pretty bleak. Hauser, however, is somewhat more optimistic.

‘I think all these criticisms are absolutely correct but if you stand back and look at it over longer periods of time, as I can, things have improved enormously,’ he says. ‘When I did my first company, Acorn Computers, there was no venture capital, full stop. The concept didn’t even exist. You went to the bank to get the money, which thankfully we did at Acorn.

‘We do now have venture capital in this country, which is reasonably competent and sector-focused. So it has built up the sector expertise in areas of technology.’ But thanks to the combined effects of the late 1990s dot-com bubble and the ongoing financial crisis, he says, European venture capital levels have fallen back to what they were before 1997, when Hauser started Amadeus.

However, he argues, this makes the potential reward for those willing to risk investment much greater. And the UK’s venture capital sector is now much more mature. ‘I think the venture funds that are being raised now will give very good returns because all the building blocks are now in place. We’ve never had a problem with technology in the UK. The problem that we used to have which has improved enormously is the problem of management. We did not have the quality of managers that were willing to go into early-stage companies. At Amadeus Capital Partners, we did 17 per cent of our deals ten years ago with serial entrepreneurs. This has now risen to 70 per cent. So Britain has created a class of serial entrepreneurs that didn’t exist before.’

Of course, as founder of a venture capital fund, Hauser has a vested interest in promoting investment in the sector. He doesn’t shy away from self-promotion or name-dropping, either. When you ask his opinion on something, he’ll often give it to you intertwined with a story about another company he helped launch or a time when he was hanging out with the likes of Google co-founder Larry Page, casually mentioned by first name only. But it’s always done with a dry sense of humour and a readiness to acknowledge the hard work and genius of his collaborators.

Cambridge has produced 11 billion-dollar companies, only five of which have anything to do with me

‘Because we have been very lucky in clusters like Cambridge, we’ve had a number of successes: Cambridge has produced 11 billion-dollar companies, only five of which have anything to do with me,’ he says with a wry smile. ‘And that means that we could attract people from across the pond. So in the case of Solexa [which developed cheap gene-sequencing technology] for example, we managed to get a guy who ran a billion-dollar division of a big American company to head up a startup.’

The problem that remains for small UK firms is the lack of connections with global corporations, he argues, unlike in Silicon Valley where entrepreneurs can mingle with people from Google and Apple, big companies that can supply middle management figures and buy-up promising technology.

There’s another issue around Britain’s lack of big players in electronics and computing. If a small technology firm undergoes a foreign takeover, the chances of its value, and any potential manufacturing operation, going abroad are increased. If the company can’t find a corporate buyer, then it has the even greater task of building itself into a global operation. And the immense amount of capital investment required to do this often leads firms to either license their technology (as microchip-designer ARM Holdings does) or outsource manufacturing to a cheaper location. So the task of creating a new generation of British manufacturing jobs, as the government hopes to, involves much more difficult problems than simply spinning out more companies from universities.

‘I think that’s absolutely right,’ says Hauser. ‘But let me make a few remarks. First of all ARM is the exception that proves the rule in many dimensions. We sold 9bn ARMs last year … we outsold Intel 20 to one. [And] even in dollar terms ARM is now the more important architecture. So we do have British companies that can make it on a global scale.

‘Having said that, the way people talk about manufacturing is a little bit too narrow. It is completely loony to think that we can do the whole stack here. We’ve got to be smart enough to pick the one layer where we are going to be better than anyone else, which might well be advanced manufacturing. But pick the fight that you can win, [don’t say] “manufacturing has to be in the UK”.

That’s a difficult message for politicians hoping to create thousands of medium-skilled manufacturing jobs. ‘Yes, it’s that old-fashioned connection that people make,’ says Hauser. ‘When they think of manufacturing they think of thousands of people putting cars together or something. If you want to create employment you really want to think a lot more about the services that are associated with that industry and not necessarily manufacturing, because a lot of the advanced state-of-the-art manufacture is done by robots anyway. One of the reasons why Apple is bringing their manufacturing back to the US is the labour content of putting an iPhone together is minimal.’

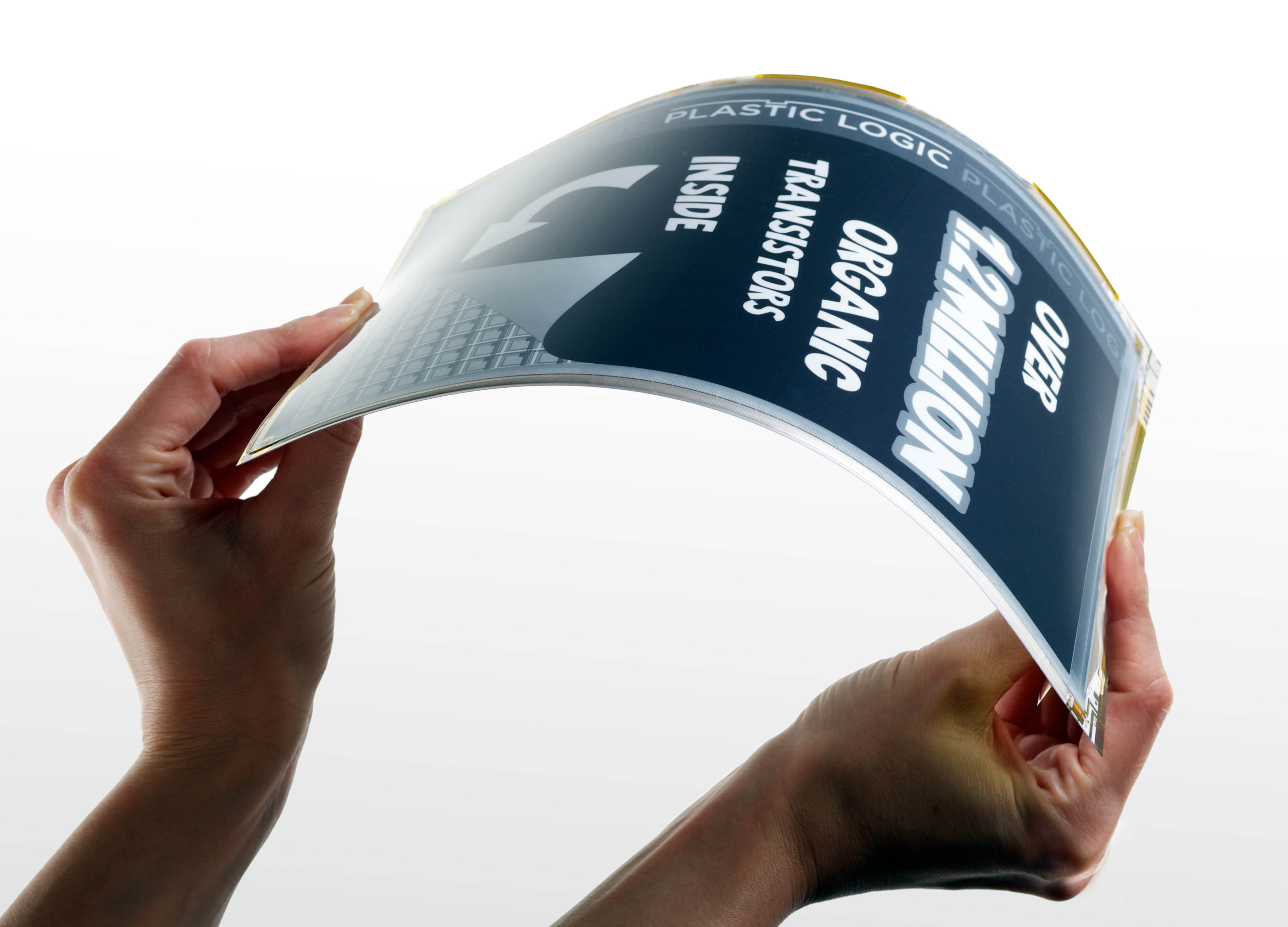

So where can the UK make its mark? One exciting prospect is the budding market for wearable computers. True, it’s likely to be led by the likes of Apple’s upcoming iWatch and the head-mounted Google Glass, about which Hauser is particularly enthusiastic (‘It’s a very elegant way of improving your relationship with the world’). But he also believes there are opportunities for British firms in wearable medical sensors and flexible electronics. Cambridge-based Plastic Logic, for example, has unveiled a flexible tablet computer designed with Intel. And the UK could do even more in this sector if it’s successful in developing applications for graphene, the super-strong, flexible and highly conductive material discovered at Manchester University.

‘You could take graphene platelets, put them into an ink and then solution-process the graphene, which is completely compatible with the Plastic Logic solution-based process, and you can make a plastic transistor. Graphene has characteristics that are good enough to drive OLEDs, and that’s the nirvana of the display industry. This is all within our grasp and we’re world-leading.’ Incidentally, who was Plastic Logic’s founding chairman? That’s right. Hermann Hauser.

Biography

Education

- 1969 MA in physics, University of Vienna

- 1972 PhD in physics, Cavendish Laboratory, University of Cambridge

Career

- 1978 Founded Acorn Computing with Chris Curry; instrumental in development of ARM microprocessor

- 1985 Olivetti takes over Acorn; Hauser becomes vice-president for research

- 1986 Co-founder of Olivetti Research Lab at Cambridge

- 1988 Founded Active Book Company; later acquired by AT&T

- 1990 Involved in spin-out of Advanced RISC Machines from Acorn

- 1993 Co-founder of Advanced Telecommunications Modules

- 1996 Co-founder of Amadeus Capital Partners investment company

- 2001 Co-founder of Hauser-Raspe Foundation to advance education

- 2001 Honorary CBE ’for innovative service to the UK enterprise sector’

- 2004 Joins government’s Council for Science and Technology

- 2009 Lead author of the ‘Hauser Report’

- 2012 Made a Fellow of the Royal Society

Glasgow trial explores AR cues for autonomous road safety

They've ploughed into a few vulnerable road users in the past. Making that less likely will make it spectacularly easy to stop the traffic for...