Engineers are great at explaining technology but often bad at explaining their business, which can create difficulties when approaching investors, says Sorin Popa

One of the most daunting challenges for engineers is to communicate their vision to those who have the money to make it happen. Engineers can have a completely different perspective to investors, to such an extent that we often seem worlds apart. Investors are naturally risk-conscious, commercially minded and may lack deep technical expertise; engineers, while often visionary, can get so caught up in the technical wizardry of their invention, that they can neglect its real-world commercial potential.

Engineers are great at explaining technology, but often bad at explaining their business. They sometimes struggle to outline the need it satisfies (what problem does it solve), the business model, the different potential revenue streams, the ‘white space’ the technology occupies, or its most lucrative USP. Engineers can also forget that technology is useless if no one wants to use it at that cost.

Yet, without the financial advice and expert guidance of investors, as well as the funding itself, many great ideas will never get off the drawing board. So how can we build bridges between the engineering and investment communities?

I recently had the opportunity to learn what makes investors tick, when I attended a Royal Academy of Engineering Reverse Pitching event where engineers can hear real investors explain the different funding options – from bond loans to venture capital – and learn how funders make their decisions.

For once, investors had the chance to pitch to engineers and explain the things every engineer needs to know if they are to get their dream deal.

Engineers must first understand the distinctions between different types of investor, their field of interest, what they look for in an investment and what engineers can do to sell themselves more effectively to each kind of funder.

We learned that angel investors, as high-net-worth individuals who are investing their own money, will only back companies that they feel passionate about and may want to be personally involved in each of their investments. This means they can be very hands-on and will routinely visit and advise a company they have invested in. Other angels prefer to join as part of a syndicate of investors and contribute primarily through the investment alone.

Venture capital funds, however, have very different expectations, because they are spending other people’s money. Venture capitalists invest at a later stage than angels, are unlikely to invest before there is an actual product and, in some cases, they will not invest unless the company already has confirmed orders. Venture capitalists are far more ‘hands-off’ and probably won’t come in and help to run a company – they may however want to appoint someone to your board. Engineers will also have to be prepared to open the innards of their company to a thorough audit as venture capitalists have to do more due diligence before making a deal because they have a duty to their limited partners.

It’s also vital to understand the different types of venture capitalists and angels; some investors want to spend time scaling up the business before expecting a return, while others want rapid ROI. Every engineer must ensure their business model and growth plans match with the goals of their investor.

Venture capitalists typically won’t invest in two similar technologies in the same sector because this would produce a conflict of interest in their portfolio, so engineers must research their

other investments.

It is important to research the sectors they invest in, as funders often will not invest outside sectors where they have particular expertise. There is no point in a biotech entrepreneur seeking funds from a venture capitalist specialising in B2B service apps.

You must demonstrate that you are business savvy, as well as an innovative engineer, because investors are risking their money on the ability of the founders and their team to run a successful business, not just the commercial potential of the technology. Investors know the wrong management team can ruin the chances of any business from becoming successful, and this is why building a strong team should be a primary goal.

You need to look for an investor with the right kind of ‘risk appetite’. If you have very early-stage tech, that will take a good while to come to fruition, you need to make sure that the investors you approach are willing to take on that level of risk and you probably need to accept that you are likely to give away more of your equity at such a stage. Check how long any venture capitalist funds have been around for. If they are new, they are likely to have more appetite for risk; conversely if they have been around a number of years, chances are the fund will be closing soon so you might get a ‘no’ for that reason – it might not be anything to do with the viability of your business.

An investor-company relationship could last longer than the average marriage so it is vital to ensure you are a good match with any prospective investor and cultivate a good relationship from the outset.

To land an angel investor, it is vital that engineering entrepreneurs present themselves as motivated, goal-driven founders who have built or are willing to build a strong management team and can clearly communicate their vision. Angel investors do not just view their portfolio as an abstract balance sheet; they see each investment as personal and they have to be able to get behind the people as well as the product. Talking about your personal motivation, background, goals and ambition can be as important as talking about the product.

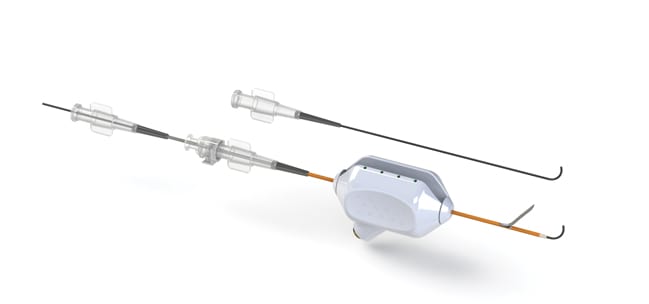

Sorin Popa is CEO of Stent Tek, which is currently developing a novel catheter system for minimally invasive vascular access

Project to investigate hybrid approach to titanium manufacturing

What is this a hybrid of? Superplastic forming tends to be performed slowly as otherwise the behaviour is the hot creep that typifies hot...