Cars have traditionally always been more than just vehicles. They have been objects of desire, inspiring devotion, conferring status, penetrating the psyche of our collective consciousness. But attitudes about mobility are shifting, and car ownership is no longer the exalted goal of times past. Increasingly, people just want the best possible solution to get from A to B, with waning emotional attachment to the method of travel. In order to reflect that, the car industry may have to radically adapt its practices.

The automotive business model hasn’t really changed since the days of the Model T. Manufacturers produce cars which are sold more or less directly to customers, who then become the outright owners. Leasing has grown in popularity recently, but exists predominantly as a mechanism to reduce the barrier to purchase. Ultimately, the industry’s business model depends on obsolescence and volume, and is implicitly inefficient as a result. What’s more, it’s a model that precludes OEMs from the bulk of expenditure over a vehicle’s lifetime.

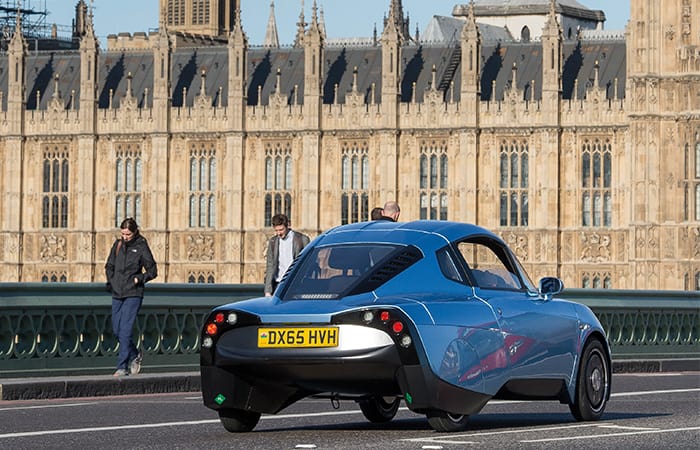

Riversimple's Rasa will seek to instigate a completely new car ownership model (Credit: Anthony Dawton)

“When a car is sold, less than 40 per cent of the revenue generated by that car in its life goes to the manufacturer,” Hugo Spowers, chief engineer and founder of Riversimple, told The Engineer. “Sixty per cent goes elsewhere, and they can’t access it, whereas we can.”

Riversimple, a start-up based in the heart of Wales, is taking an entirely new approach to mobility. Its hydrogen-powered vehicles, spearheaded by the two-seater Rasa, will remain the property of the company throughout their lifetime, with Riversimple offering mobility-as-a-service (MaaS). Customers will pay a monthly fee – comparable to the current monthly cost of car ownership – that will also cover all fuel. This incentivises Riversimple to focus on efficiency, investing upfront to reap rewards further down the line.

“Efficiency does cost,” Spowers explained. “It’s more expensive to make a more efficient car. It eats into your profit margin, so the industry can only lobby against those regulations and cheat when they come into force, which we’ve seen recently. We need to make efficiency profitable, and that is the single biggest change we need to see to improve the environmental impact of transport.”

According to Spowers, the automotive industry is fundamentally flawed, based on a model that encourages waste.

“Your interests are obsolescence and high running costs, because that’s what you make your money out of,” he said.

“I simply don’t see how you can ever have a sustainable industrial system based on rewarding industry for the opposite of what you’re trying to achieve. It’s just fundamentally not very clever.”

What’s required, Spowers says, is a more holistic approach - a cradle-to-grave perspective on the life of the car. If obsolescence no longer underpins the market, this encourages different methods of design and manufacture, methods that work for the benefit of all parties as well as the environment.

Prof Raj Roy has been beating this particular drum for many years. He heads up Cranfield University’s Through-Life Engineering Services (TES) Institute, an organisation dedicated to research and education on how to manage high-value products for the duration of their existence.

“At Cranfield, we’re looking at engineering for life, and I think for us that’s really important,” said Prof Roy. “So when you engineer a product, you need to think how that product is going to behave for the entire lifecycle. That’s number one. Number two is how you can increase life. That’s also important for us because we want to reduce resource consumption and, for that, extension of life is important.”

The emergence of TES has been driven by a wider trend across industry called servitisation, whereby services are sold to customers instead of products. Examples of this can be seen everywhere. Companies like Microsoft, that once sold Windows packages by the millions, now operate predominantly via subscription models, selling software as a service (SaaS). Where Xerox once relied on sales of printers and toner, it now provides managed print services and document management solutions.

Servitisation has grown in popularity recently, but it’s been around for a long time. As well as selling engines, Rolls-Royce has been selling Power-by-the-Hour for over 50 years. By offering engines for a fixed-cost-per-flying-hour, the interests of the company and its customers became more closely aligned, with Rolls-Royce only paid for engines that were running. The incentive became to design for the long term, extending the overall lifetime of the engine. Designing cars for the long term – and dealing with the associated drop in volume – is something the car industry needs to prepare for, according to Prof Roy.

“Car design has to change to survive such a long lifespan, in terms of mileage,” he said. “We’re talking about half a million to one million miles per car. That’s one challenge: how to design cars for that.

“Number two – how do you cope with reduction in volume? The automotive sector today very much depends on volume, and car production volume – or the number of parts – is going to go down significantly in the future, because of mobility as a service. Each car will last longer, and the car will need to be designed in such a way so that new technologies can be introduced as time progresses.”

This long-term mindset has been adopted by Spowers and Riversimple from day one. From the earliest drawing-board concepts to the latest engineering decisions, everything is geared towards the overall efficiency of the car and the system in which it operates.

“In our case, we design knowing it’s going to be on our balance sheet for its lifetime,” said Spowers. “A typical car lasts for 13 years. We model around 15 years because it sounds credible, but in fact we think we can get a longer revenue stream out of it than that.”

Riversimple’s MaaS model for the Rasa will see customers essentially leasing the cars under contract for a set period of time. However, rather than individual ownership, many believe the future of MaaS lies in car-sharing services where mobility can be accessed on demand. Companies such as Zipcar are already providing these services. The US firm – bought by Avis in 2013 – has brought car-sharing to more than 100 cities around the world and claims to have over one million members.

The Autolib' Bluecar carsharing service has impacted car ownership in Paris

Zipcar’s UK fleet includes hybrid VW Golfs, but newer entrants to the car-sharing market are going pure electric. In Paris, the Autolib’ scheme uses a network of a few thousand Bolloré Bluecar EVs to deliver MaaS. Similar to the bike-sharing schemes found in most major cities today, users can pick up and drop off the cars at various points. But if the network is to function properly, a critical mass of vehicles must be available at any given time.

“One of their selling points is that you are never more than 100m from one of their cars,” explained Dr Paul Nieuwenhuis. “But it has to be waiting for the system to work.”

Nieuwenhuis is co-director of Cardiff University’s Centre for Automotive Industry Research and the university’s Electric Vehicle Centre of Excellence. He agrees with Professor Roy that the automotive industry is moving towards a completely different business model, though he isn’t as certain that a drop in production volume will automatically follow.

“Some people have started to dig a bit deeper and are saying that in order for these shared cars to be available as and when you need them, you must have quite a few sitting around waiting for someone to need them,” Nieuwenhuis said.

Car sharing is undoubtedly on the up, but just how much penetration it will have still remains to be seen. It’s unlikely to eclipse outright ownership anytime soon, though it certainly has the potential to impact the bottom line of OEMs, regardless of how future driving habits evolve. Electrification, connectivity and autonomy are all precipitating change. Manufacturers are operating in a space that’s in almost continuous flux, and one in which their traditional business models may no longer be fit for purpose.

“Even if we only consider the move to electric, this means quite a different business model,” said Nieuwenhuis. “One has the feeling that only Tesla has really appreciated that. Tesla has a fully integrated model which involves getting into the energy generating end, energy distribution, battery technology, making the vehicle and charging.

“So they’re putting everything together, whereas most of their competitors are focusing on the car rather than the system that you need. And I think they’ll come under increasing pressure to take a different approach beyond the car, as it were.”

Advances in materials are another key agent of change. The chassis of Riversimple’s Rasa is a carbon fibre monocoque that weighs less than 40kg. With the company on the hook for the hydrogen that will power it, the weight is crucial. Equally as important is the fact that it will never rust, with everything about the vehicle geared towards longevity and value through to end-of-life.

“If it’s going to be our car at end-of-life, we design it for maximum recovery of value,” explained Spowers. “So that end-of-life liability, which the industry regards as about 200 quid, in our case becomes a credit. We call it zero in our financial model because we don’t know how much it is, but it’s certainly a positive number.

“The car has no moving parts other than the wheels. There’s no metal-to-metal wear, no lubricants, no oil changes and so on. And there’s also no corrosion because all the structural materials are inert. So it’s designed for a much longer life, and that long tail of revenue is much longer than I think the auto industry acknowledges.”

Nieuwenhuis agrees. According to him, the big players in the auto industry are simply not set up to think in this way. Despite many OEMs making significant moves in electrification and autonomy, a century of competition based on volume has left them ill-equipped for a future that could see their modus operandi so profoundly disrupted.

“The industry is totally focused on the new car sale, but loses interest once it goes to a second, third, fourth, fifth owner,” he said. “But that is most of the market, that used-market, and OEMs are not geared up to deal with that. Once you start going to a model where the minimum use phase of a car is not 15 years but 30 or 40 years, you need a completely different business model, because you’re not going to be able to run a business based on replacement demand.

“You have to engage with that use phase. You have to move to either a mobility service business model or something that at least manages that use-phase over several decades.”

Remaining engaged throughout that use-phase is core to Riversimple’s strategy. Spowers describes the Rasa as a car that is ‘local’, but not restricted to being urban. People living outside towns and cities, where public transport is usually sparse at best, are generally more reliant on cars.

A single hydrogen filling station in a small city like Oxford – or a town such as Abergavenny that will host a Rasa trial later this year – could easily support 50 vehicles operating within a local radius. What’s more, the commercial proposition of that station is much stronger, backed by the knowledge that there is a geographically secure customer base.

“The car’s got a 300-mile range, not for a 300-mile journey, but to be at least a week’s use of fuel,” said Spowers. “And that supports a market with a radius of about 25 miles around a market town or a small city, with one filling station creating the commercial market.

“If we put 50 cars into that market, they’ll all use that one filling station, so the investment case for the filling station is much, much stronger. Then you can grow your market one filling station at a time and incrementally grow the skeleton of a nationwide network. Then at some point in the future, when there’s enough hydrogen around, we’d launch an intercity-capable five-seat car.”

Riversimple's last-mile delivery van concept

That motorway-ready car would require a network of around 300 filling stations around the country, so it’s not something that will be seen in the near future. However, the company has more immediate plans to add to its fleet. The next concept in the pipeline is another ‘local’ vehicle, but for last-mile delivery rather than personal mobility.

“This will be a lighter vehicle with a lower payload than comparable vehicles, but it will be very, very efficient,” claimed Spowers.

“It will use virtually exactly the same powertrain as the Rasa, we can make it in the same plant and also, critically, use the same infrastructure logic.”

Ultimately, Spowers wants to help bring about a new type of mobility system - one that’s cleaner, operates more efficiently and manages resources through all stages of a vehicle’s existence.

The end result, however, could be anathema to the rest of the automotive industry.

“We’re probably the only car company in the world who not only hopes never to sell a car,” he said, “but thinks there are actually far too many cars on the planet.”

Viking Link connects UK and Danish grids

These underwater links must, based on experience with gas pipelines, be vulnerable to sabotage by hostile powers. Excessive dependency on them could...