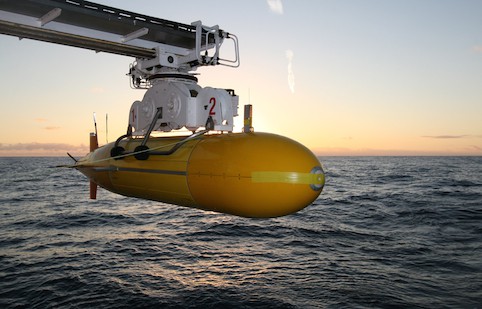

At the time of writing, somewhere in the depths of the southern Indian Ocean, the Bluefin-21, an advanced unmanned submarine operated by the US Navy, is probing the seabed for signs of missing Malaysia Airlines Flight MH370.

Bristling with some of the most advanced underwater imaging and navigation systems available, the Torpedo-shaped vessel represents perhaps one of the best chances of finding out what happened to the missing airliner.

While its operators hope it will emulate the similar vessel that famously located the Air France flight lost off the Brazilian coast in 2009, experts admit that the odds of success are slim: the search corridor is dauntingly huge and the water 4,500m deep or more in places. It could, one specialist told The Engineer, take decades to map the area currently being looked at.

But whether or not the high-tech submersible helps solve the mystery of what happened to Flight MH370, its headline-grabbing cameo has thrown the spotlight on a rarely glimpsed area of technology that’s fast becoming indispensable for anyone with a stake in the marine environment: the autonomous underwater vehicle (AUV).

AUVs are now relatively widely used by both the oceanographic research community and the defence sector, where their ability to quietly operate for long periods deep beneath the surface and to return detailed data from the seabed, makes them ideal for a range of applications. But now, dramatic improvements in capability, coupled with our insatiable demand for energy, are driving a growing use of the technology in the offshore energy industry.

The trend was one of the key talking points at London’s recent Oceanology International conference (March 2014), where manufacturers, survey companies and energy firms all pointed to the growing use of AUVs for a range of subsea survey and inspection tasks. Indeed, Tom Hiller, a senior engineer from Teledyne Gavia — one of the leading AUV manufacturers — told The Engineer that operators are now even beginning to specify AUV solutions in contracts.

The technology certainly has some compelling advantages: AUVs are faster than the remotely operated tethered vehicles (ROVs) that are widely used in the offshore sector. And, because they’re able to operate autonomously under their own power, are less of a drain on resources: operators can put them in the water, leave them, and go off and do something else. But it’s the quality of the data they can gather that’s really driving their use. Able to fly metres above the seabed — or close to subsea installations — AUVs enable operators to rapidly deploy a range of high-frequency sonar systems and cameras to gather detailed subsea data.

What’s more, the technology also enables operators to access areas that are off-limits to other equipment, an attractive capability for an industry that’s moving into ever-more remote environments.

In one particularly striking example, a team of academics from Southampton’s National Oceanography Centre (NOC) recently sent a long-endurance AUV known as Autosub 3 into completely unchartered territory 60km beneath the Pine Island glacier in the western Antarctic. ‘The technology gives you capabilities you just couldn’t get any other way,’ commented Dr Maaten Furlong, who leads the centre’s Marine Autonomous and Robotics Systems group (MARS).

The real challenge of underwater is that electromagnetic radiation doesn’t really penetrate

Dr Maaten Furlong, National Oceanography Centre, Southampton

Furlong believes the growing use of the technology has been driven in part by the popularity of other types of robotic system, such as unmanned aerial vehicles (UAVs). But he stressed that the ocean is a uniquely difficult environment in which to operate: ‘The real challenge of underwater is that electromagnetic radiation doesn’t really penetrate. All your radio goes down. You go 1cm under water and you’ve lost GPS. You can’t see very far. You can’t use radar systems: as soon as you submerge, navigation becomes an issue.’

Despite these challenges, the technology is, he said, now reaching a tipping point where recent advances are helping to drive down the cost and make it more appealing. ‘We’ve suddenly got to the point where it doesn’t cost vast amounts of money to build these systems and because going to sea is phenomenally expensive, these kinds of systems offer the opportunity for a significant reduction in cost.’ The emergence of MEMs sensors is, Furlong said, one area that has made this possible. ‘A single chip now will give you a three-axis magnetometer and a three-axis accelerometer, so you can do the navigation side of things very easily.’

Industry shares the view that the technology is marching on. Richard Mills, product sales manager for AUVs at Norwegian firm Kongsberg Maritime, a manufacturer of deep-water long-endurance AUVs, pointed to improvements in battery technology as a major area of improvement in recent years. ‘Energy density has improved,’ he said, ‘you can get much better payload draw and much better endurance than you used to be able to get.’

Mills also singled out the growing use of forward-looking sonar as a major step forward. As well as improving collision avoidance, he says that such systems have made it easier for AUVs to fly at a consistent attitude over the seabed and smooth out the contours, enabling significant improvements in the quality of the data gathered by the vessel.

As well as ongoing improvements in performance, one of the key trends driving the uptake of AUVs is the oil and gas sector’s desire to exploit the untapped reserves in some of the more remote and deeper areas of the ocean.

According to a recent report on the AUV market by industry analyst Douglas-Westwood, deep-water operations have been responsible for 67 per cent of growth in oil production over the past year.

The report argues that — with the cost per barrel of oil rising by an average of 11 per cent a year — the use of AUVs for survey and inspection represents one of the key ways in which operators will be able to reduce their costs. It predicts that oil and gas will account for nine per cent of the total AUV market by 2018 and claims that 2014 will be a pivotal year for AUV operation in the commercial sector.

There are a number of systems available for deep-water operation. The key manufacturers, though, are Saab, Bluefin and Kongsberg Maritime, which produces the Hugin AUV.

The most commercially successful system of its kind, the Hugin is widely used by the defence industry. Depending on configuration, it is able to operate at depths of 4,500m, has a maximum endurance of 74 hours and a top speed of six knots.

Fugro Survey, which operates one of the largest fleet of commercial Hugins, has used the system for some of the most ambitious deep-water surveys to be carried out. The firm recently carried out the world’s largest AUV survey for ENI off the coast of Mozambique, where it used the technology to examine around 1,440km2 at depths of up to 2,700m.

Eric Robertson, a commercial manager with Fugro Survey, said that the company was also recently involved in the first UK deep-water AUV survey, when it used its Echo Survey IV vessel (a specially adapted Hugin 1000) to provide seabed data for Chevron’s Rosebank project: a discovery in the West of Shetland.

Another leading survey company, C&C Technologies, has also been involved in a number of recent deep-water projects, including the first AUV survey work in the Caspian Sea for BP. Talking at the Oceanology International conference, the firm’s vice-president of systems development, Jamie Cheramies, said that its fleet of four deep-water AUVs, all based on Kongsberg’s Hugin line, have surveyed more than 325,000km of seabed. He added that AUVs have now completely replaced the towed sled technology that the company once used to image the seabed.

However, while most agree that the push for deep water is a big driver for uptake of the technology, it’s not the only factor at play.

Indeed, Kongsberg’s Mills said that the rise in so-called low-logistics AUVs (less-expensive systems that can be rapidly reconfigured for different applications) are also making the technology compelling for shallower water.

It’s an area that he believes, in the immediate future, potentially represents a bigger market. ‘Ninety-five per cent of the North Sea is shallower than 1,000m and in the Gulf of Mexico 80 per cent of existing fields are shallower than 1,000m,’ he said. ‘The new blocks released by the US government earlier this year are now going to 3,000–3,500m but that’s five years away for exploitation — it’s a slow incremental change.’ Last year, in an effort to capture a share of this market, Kongsberg launched the Munin – a low-logistics AUV available in 600m and 1,500m rating versions.

Mills said that the technology has a number of advantages over traditional survey techniques, which, in shallower water, have tended to be based on surface vessels. ‘What AUVs can do that traditional survey techniques can’t is get really up close to where the data is collected from, so the quality, even in shallow water, is always going to be significantly better. If you’ve got 50m of water and you’ve got a good multibeam on a surface-mounted vessel, you’re not going to get such a good resolution.’

He added that subsurface techniques also allow engineers to move a lot of the instability form wave conditions. ‘Small survey launches are not necessarily the most stable ships in the world. If you get rid of the wave action by putting the sensor package underneath the water then it increases the data smoothness, quality and consistency.’

One of the most widely used low-logistics vessels is Teledyne Gavia’s Gavia Surveyor, a modular system, able to operate at depths of up to 1,000m, that can be rapidly reconfigured to carry a range of different sensors.

Outlining one potential application of the technology, Teledeyne’s Hiller said that the Gavia can be equipped with a sub bottom profiler — a system that creates a 2D image of the geology beneath the seabed — and used to analyse the stability of slopes where an operator might want to install a pipeline. ‘That’s very hard to do from a surface vessel,’ he said, ‘especially where you have layers of sediment for the first 4–5m and it’s on a shallow slope and you want to know whether those layers are going to fail at some point and slide down into the deep. You don’t want to put a pipeline across that.’

One of the big problems with the AUV is it is autonomous. It goes off and does a survey and comes back, and people are scared of that

Tom Hiller, Teledyne Gavia

Fugro’s Eric Robertson added that lower-logistics systems are also proving to be useful in the offshore wind sector where they are being deployed to hunt for unexploded mines. He explained that unexploded ordnance is a major problem for wind farms — which have a far wider seabed footprint than oil and gas platforms.

But despite a growing realisation among operators that AUVs offer some distinct advantages, there is still some reticence in industry about investing in autonomous technology. An ROV tether is a reassuring link with an expensive piece of equipment and companies are nervous about severing this link, and placing their trust in a highly expensive fully unmanned system. ‘One of the big problems with the AUV is it is autonomous,’ said Hiller. ‘It goes off and does a survey and comes back, and people are scared of that: they don’t want to look at some data 10 hours later and realise they’ve sent the AUV in at the wrong height.’ An even greater concern is the fear that the system could be lost. And although manufacturers deny that this is much of an issue, one source told The Engineer that losses of commercial AUVs do occur.

Mills believes that if the AUV sector is to continue to grow and win the trust of the industry, it needs to be mindful of these concerns. And he said that Kongsberg is already some way along the line of endowing AUVs with ROV-type communication ability. He explained that the firm’s cNODE transponder system (which is used on both the Hugin- and Munin-class vessels) enables bursts of data to be sent between an AUV and a surface vessel, and does allow a degree of real-time communication and even control. ‘The industry we’re working with has a background in ROV operation you have to give it the safety blankets it asks for. This allows the operator to see they’re collecting meaningful data, that the settings are right, that you haven’t got any gaps in the data and you’ve got real-time supervised control of the vehicle.’

I just want to see an all-singing, all-dancing underwater robot

Richard Mills, Kongsberg Maritime

Another capability that could further consolidate the role of AUVs will be vessels that are able to hover. ‘A cruising AUV can do a scan survey around the base of a wind turbine quite nicely’ said Mills, ‘but if you want to inspect the turbine structure itself underwater that’s a different task: you’ll want to get up close and maintain position while you take some hi-res video or photos.’

Mills said the ‘holy grail’ for AUV developers is ‘autonomous intervention’, the ability for a vessel to carry out the kind of seabed work that can only currently be performed by ROVs or divers. ‘Ultimately’, he said, ‘I just want to see an all-singing, all-dancing underwater robot.’

Making waves: subsea gliders

Another class of unmanned vehicle that’s beginning to attract interest from the offshore energy sector is the subsea glider.

Originally developed for oceanographic research, gliders use a highly efficient form of propulsion based on wings and small changes in buoyancy.

On the surface, the vehicles suck in a small amount of water, which alters their buoyancy and causes them to sink. As they do so their wings convert the sinking energy into forward motion. When they get to a certain depth they pump out the water and rise up and are driven forward again.

Zigzagging slowly through the water — they travel at around 35cm per second — and able to stay afloat for weeks, gliders are typically used by the research community to study water structures and phenomena such as ocean gyres: huge rotating currents formed by wind patterns and the rotation of the earth.

But the technology is now also being looked at seriously by the oil and gas sector. ‘It’s just coming through to oil and gas,’ said Teledyne’s Tom Hiller, ‘for example, they’re being used in the Gulf of Mexico where they’re looking for gyres: there are different kinds of work you have to stop doing around the oil-rig installations when those gyres come in.’

The technology can also be used to monitor the water for toxic spills and leaks. A fleet of gliders was deployed by the Woods Hole Oceanographic Institute (WHOI) in the wake of the Deepwater Horizon disaster. And Hiller says that his team is also looking at the potential of using the vessels during decommissioning work in the North Sea.

Glasgow trial explores AR cues for autonomous road safety

They've ploughed into a few vulnerable road users in the past. Making that less likely will make it spectacularly easy to stop the traffic for...