Given the rhetoric that surrounds advanced and high-value manufacturing every time a new investment or ‘centre of excellence’ is announced, you might be forgiven for thinking that the UK has an unassailable lead when it comes to emerging technologies.

While the country has always punched above its weight, there’s obviously huge competition to become world leaders in things like low-carbon vehicles, renewable energy generation, satellites and medical devices to name a few key trends.

Arguably, the deciding factor will be people.

Engineering UK estimates that in the next 5-10 years the UK will need at least 2 million addition engineers to be in the hunt.

‘Industry could do more if they did have more of the right skilled people,’ said the organisation’s Chief Executive Paul Jackson. ‘The number of engineering graduates coming out of the University as a proportion [of all graduates] is significantly smaller than it is in countries like Germany and way smaller than countries like Korea and China.’

Now to be fair there are signs that the message is getting through with the number of pupils taking maths and physics GCSEs on the rise and enrolment to engineering degrees general healthy. But the skills gap issue is a complex and nuanced one.

‘The number of engineering graduates coming out of university as a proportion of all graduates is smaller than in Germany and way smaller than Korea and China

Paul Jackson, Engineering UK

‘There are some areas where it’s clear that it’s difficult to recruit, for example electronics engineers — which is really quite significant when you think about the automotive and aerospace industries where it’s no longer just about the mechanical engineering, it’s a complete system they’re putting together, which means you’ve got to get the all electronics and data transfer round the vehicle or the aeroplane,’ Jackson said.

Indeed, the automotive industry has been perhaps the biggest success story for the UK since the financial crisis and production is expected to hit record levels by 2015, largely driven by demand from emerging markets where brands such as Jaguar Land Rover are proving popular.

The UK has attracted some £6bn of investment from automotive OEMs in the past two years, a real vote of confident that this a good place to do business.

‘They are not only increasing the top level number of vehicles that they manufacture, but also putting more work down into the supply chain and that is what is creating concerns about skills,’ said Paul Everitt who heads up the Society of Motor Manufacturers and Traders (SMMT).

‘Alongside that there is a very significant shift in technology going on, so the move towards low and ultra-low carbon vehicles, that puts the emphasis on power management, electrical as well as things like lightweight materials.’

But surely it’s not a hard sell to get graduates to work on luxury marques and innovative concepts?

‘Vehicle manufacturers do very well in attracting graduates for certain roles, but if you’re in the supply chain it’s rather more difficult – you might be a key supply to JLR or Ford but you will not be a well know brand, you will not have a great deal of public visibility. Whilst people might want to get into the automotive sector they might not necessarily see some of those supply chain companies as the route they want to go, so that’s a challenge.’

‘Vehicle manufacturers do very well in attracting graduates for certain roles, but if you’re in the supply chain it’s rather more difficult

Paul Everitt, Society of Motor Manufacturers and Traders

The supply chain issue is one that the renewables industry is also keen to address, particularly with wind energy. It’s often said that the UK gave away a lead in the 1990s due to lack of government support, and as a consequence only around 20% of the supply chain for wind is actually based on these shores.

There’s a desire to claw some of that back now, and also take some lessons to the nascent marine energy industry – which will require people.

‘We are expecting around 88,000 direct and indirect jobs in industry by 2021,’ said Sophie Bennett, Skills and Employment Policy Officer at Renewables UK. ‘We’re very conscious of that, so we’re doing things at the moment like trying to map the supply chain, where manufacturing is being done and where these jobs are.’

Given that the renewables industry straddles everything from grid efficiency through to turbines blade design and offshore maintenance, she would like to see aspects of this reflected where possible in degree syllabuses.

‘We’ve been working with higher education to try and increase renewables content, making people doing standard mechanical, electrical and civil engineering course aware of renewables,’ said Bennett. ‘So where currently a car gearbox is used as an example why not have a broad overview of all the different sectors that could involve gearboxes and actually use a wind turbine gearbox.’

‘We are expecting around 88,000 direct and indirect jobs in industry by 2021

Sophie Bennett, Renewables UK

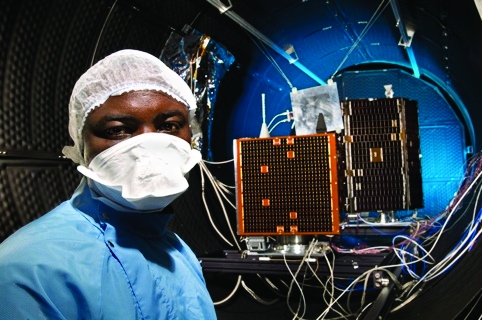

One exciting sector that is also finding its way into undergraduate programmes, if only for a lucky few, is the UK Space industry.

Contributing some £9.1 billion to the UK economy in 2010/2011, it is set to grow by around 7.5% annually.

‘Graduates seem to do very modular course in the UK, which doesn’t necessarily give them a good overview of what they’re doing,’ said Jeremy Curtis, Head of Education at the UK Space Agency. ‘The people that apply from the UK, on the whole they don’t get enough with these high-level skills, things like applied computer science, system engineering.’

Curtis favours a more project based approach, taking advantage of the opportunities that microsatellites now provide. One such initiative is UKube-1: a collaboration between the Agency, industry and academia.

‘The idea is to get various young members of the space sectors including undergraduates to work on real space projects and get real space hardware flown. That kind of thing can help a lot. Another thing we support is getting young employees to go along to the International Space University,’ he said.

Curtis divides the UK Space industry into an upstream faction, which includes manufacturers of satellites and satellites systems, and the downstream component, which make use of this technology. The latter includes things like map making and the monitoring of agriculture and cargo.

For the upstream aspect, generally it’s the brightest young people that are hand-picked.

‘On the whole they don’t need to advertise their vacancies because there are so many avenues for them to get to see the really high flyers and the high flyers make themselves know if they’re interested in space to industry,’ Curtis said.

Rather it’s the downstream aspect that is set to grow to be the larger, around ten times the size of the upstream aspect, and hence this where the skills gap will be.

‘The downstream companies are very often SMEs, new businesses setting up in rather specialised areas. In the meantime they’re recruiting from abroad. It does seem sad that we’ve got unemployment problems, an economy that needs to get moving, a sector that needs to grow, and we can’t put the two ends of that together,’ said Curtis.

All the key engineering sectors examined — including the nascent medical devices industry represented by the Association of British Healthcare Industries (ABHI) — had their own quite ambitious predictions regarding growth, largely based on solid assumptions like current market penetration.

However, the one variable each of them had in common was a large increase in engineering graduates. It’s the backbone that the models are based on.

That looks increasingly shaky unless the Government’s Department for Business Innovation and Skills can work with industry to support and co-fund new incentives to bridge the gap.

April 1886: the Brunkebergs tunnel

First ever example of a ground source heat pump?