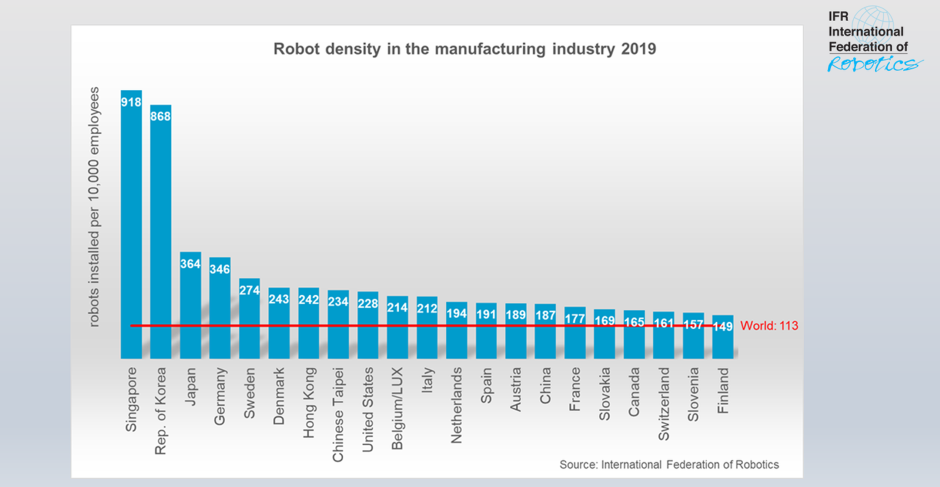

According to Robot Race: The World's Top 10 automated countries from the International Federation of Robotics (IFR), the average robot density in manufacturing has risen to 113 units per 10,000 employees and Singapore tops the list with 918 units in 2019.

Predictions for global manufacturing in 2021 and beyond

By regions, Western Europe (225 units) and the Nordic European countries (204 units) have the most automated production, followed by North America (153 units) and South East Asia (119 units).

The UK failed to make the top ten and a wider list of 11 other countries. Germany came fourth in the top ten, followed by Sweden (5), Denmark (6) and Belgium/Luxemburg (10), and then Italy (11), Netherlands (12), Spain (13), Austria (14), France (16), Slovakia (17), Switzerland (19), Slovenia (20) and Finland (21).

The top three were Singapore, South Korea (868 units per 10,000 employees) and Japan (364 robots per 10,000 employees).

Commenting on the report, Jacques Bonfrer, CEO of Bot-Hive, a company that helps first-time buyers of robotics and automation technology, said: “The situation, as revealed in the latest IFR report, is lamentable. When is the UK going to wake up to the fact that its productivity will not improve until it automates? For once such a powerful industrial nation, we are slipping behind so badly that it is going to take a concerted effort from business, the robotics and financing industries, and most particularly the government, to put things right.

“And what the awful pandemic we are now suffering has shown, is that robots can take up the slack. People are now more accepting of what robots can achieve and how they can help us through difficult times. Robots are there to relieve us of the dull, repetitive and dangerous jobs. And the rest of the industrial world is embracing them. The UK simply cannot afford to slip even further behind. We must take action now.”

Swiss geoengineering start-up targets methane removal

No mention whatsoever about the effect of increased methane levels/iron chloride in the ocean on the pH and chemical properties of the ocean - are we...