Monthly indicators from the Purchasing Managers' Index show that a drop in sterling has helped businesses exploit export opportunities, but it has also had a negative impact on input costs.

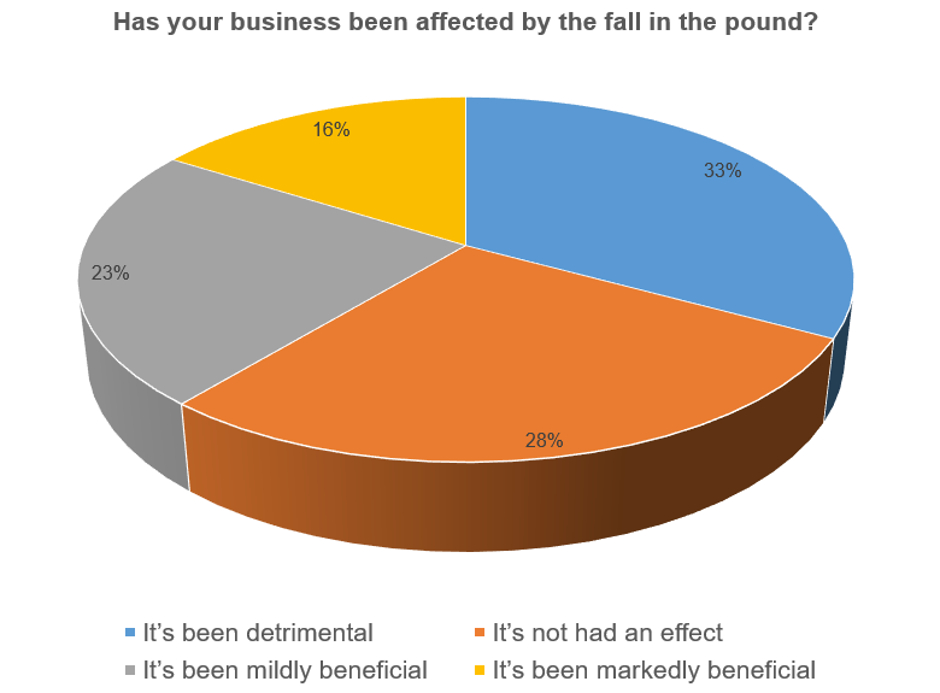

A third of respondents said that the fall in the pound has been detrimental, followed by 28 per cent who thought it had no effect.

Of the remaining 39 per cent, just under a quarter (23 per cent) thought it mildly beneficial, whilst 16 per cent agreed that the weak pound has been markedly beneficial.

In the debate that followed, David Mawdsley said: ‘An increase in export orders due to lower sterling and more competitive pricing has simply not happened, maybe due to general slowdown in manufacturing industry in other advanced countries.’

A certain John Sally Swigglebottom added: ‘Our suppliers work in Euros and Dollars. This has a direct effect on the company’s bottom line. The argument that a weaker Pound would automatically translate into bigger export orders is pure fantasy. Essentially our profits are down by 17%. Cheers Brexiters’.

Edward provided the following insight: ‘My company manufactures in the UK and the US and exports ~98% of our UK output to EMEA, AsiaPac and the US. We import some raw materials and some components from Asia (mainly Japan) and build some sub-assemblies in Asia and Europe.

‘Our markets are very competitive and our products have to be competitive in terms of performance, quality and cost or our customers will buy products from our competitors (mainly US or Japanese).

‘So, has the weak pound boosted demand or caused us problems with imported materials costs? The answer is no to both. What we try to do is balance the revenues and costs in particular currencies (where possible) and hedge currencies where it is not possible.’

The debate remains open and your comments are welcome below.

Red Bull makes hydrogen fuel cell play with AVL

Formula 1 is an anachronistic anomaly where its only cutting edge is in engine development. The rules prohibit any real innovation and there would be...