With oil prices enjoying a rebound, our poll last week asked readers for their opinions on the future of the industry.

While cleaner forms of energy such as hydrogen and renewables continue to advance, society at large is still enormously reliant on fossil fuels. The US fracking boom - coupled with Saudi Arabia's reluctance to curb production - has kept the oil price deflated in recent years, but the black gold is once again on the rise, currently trading for about $75 a barrel. A return to $100+ in the near future could well be on the cards.

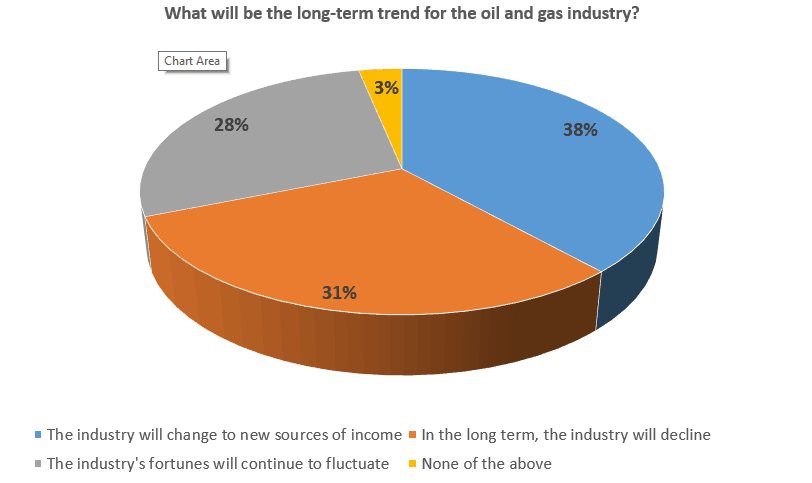

In light of this reversal of fortunes, we asked our readers about the long-term prospects for the industry. The poll saw a relatively even split between the three main options. Almost a third (31 per cent) believe that the industry will decline over time, but a higher proportion (38 per cent) think the industry will adapt to changes in the energy market, surviving on new channels of income. Although most of the petroleum giants are already invested in alternative energy solutions, oil & gas still makes up the vast bulk of their revenues, and a major shift away from fossil fuels is yet to materialise. This inertia has perhaps prompted a significant number of respondents (28 per cent) to believe that the industry's fortunes will continue to fluctuate, as they have for decades. Just three per cent of readers chose the 'none of the above' option.

"While a change away from oil & gas to renewable energy etc is inevitable, we are still dependent on oil for various products & will continue to be so until an alternative is found," said a reader named Dave. "There needs to be more innovation, pushing of boundaries, progress & invention of new technologies."

Another commenter made an interesting point about the effect that a decline in the oil & gas industry would have across the huge supply chain that supports it.

"The bigger picture isn’t the O&G companies but all the businesses that support this industry, steel, valves, pipeline etc. and those that rely on the product – plastics, transportation (both vehicular and infrastructure – roads runways etc.)," wrote Chris. "The world is so tied to these hydrocarbons that when the end comes it could be catastrophic."

Finally, an industry insider who went by the name giason put the fluctuating fortunes of oil & gas into context.

"Many industries would just die with the cost base change that oil and gas has had. In 2014 Brent crude was peaked at $114 a barrel, falling to a low of $28/barrel in 2016 (76 per cent reduction in price)"

"Oil and Gas has always been a boom/bust cyclic industry, I’m sure this will remain. Offshore Oil and Gas projects have huge project capex costs (typically in billions) , and unless that can be assured on the returns the industry will be slow to recover. We’re getting there, but it’s cost a lot of jobs in the process."

The comments section will remain open for readers to continue the debate.

Nanogenerator consumes CO2 to generate electricity

Whoopee, they've solved how to keep a light on but not a lot else.