But beyond the northern tip of the British isles, in the deep and choppy waters to the west of the Shetland Islands, a new era of exploration and development is underway that brings to mind the optimism and excitement of the early days of North Sea oil.

Although discoveries were made in the West of Shetland (WoS) area back in the 1970s, it’s only relatively recently that the industry has begun tapping into the region’s potential. Declining fortunes elsewhere in the North Sea have made these harder-to-reach reserves more appealing, while new data-gathering and production technologies, as well as lessons learned from harsh environments elsewhere on the planet have given industry the confidence to begin exploiting this new frontier on the edge of the UK continental shelf.

The ultimate potential is still unknown

Oonagh Werngren, Oil and Gas UK

The prize could be huge. ‘We think that the West of Shetland region represents about 17 per cent of UK’s remaining oil and gas resource base, and the ultimate potential is still unknown,’ said Oonagh Werngren, operations director of Oil and Gas UK.

The main player in the region is BP. Its Foinaven field, 190km West of Shetland, was the first development of its kind West of Shetland and, along with the nearby Schiehallion and Loyal fields, has been producing oil since the late 1990s.

But although all of these fields are thought to have a promising future, BP’s most significant activity centres around the giant Clair field which, with an estimated seven billion of barrels of oil and gas in place, is the UK’s largest hydrocarbon resource.

Oil was first discovered at Clair in 1977 but it wasn’t until 2005 that the field began producing. It has been churning out 40–50,000 barrels a day ever since.

BP is now well into the development of the second phase of the initiative, the £4.5bn Clair Ridge project, which will come on stream in 2016 and is expected to produce around 640 million barrels of oil. The huge jackets designed to support the two bridge-linked platforms at the heart of the facility were installed on the seabed earlier this summer.

A number of technologies have been key to the development at Clair. BP has invested heavily in seismic techniques that have improved its understanding of complex geology of the area. While innovations in horizontal drilling technology have enabled access to a difficult area.

But arguably one the most significant developments for phase two of the project will be the use of a new Enhanced Oil Recovery (EOR) process that the firm claims will liberate an additional 42 million barrels of oil from the reservoir.

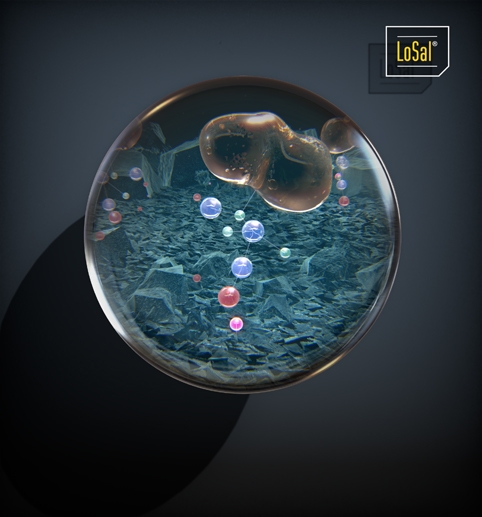

EOR -— a suite of different techniques that typically inject chemicals, miscible gas or heat into a reservoir in order to alter its properties — is increasingly widely used throughout the industry to boost the amount of oil that can be recovered. But while many of these techniques rely on exotic chemicals (and add considerable costs to the operation) BP’s new LoSal technique, which will be used commercially for the first time at Clair ridge, uses nothing more exotic than low-salinity water.

Andrew Cockin, BP’s upstream technology innovation leader, said that the rest of the industry thought BP was joking when it started talking about the technology, but that there is now industry-wide interest in a technique that dramatically reduces the cost of EOR. ‘LoSal costs you about $4/barrel but EOR technology in the past has been about $30/barrel and that’s why nothing happened,’ he told The Engineer.

Explaining the background to the technology, Cockin said that water flooding has long been used to help push as much oil as possible out of the reservoir but the technique still leaves much of the oil behind. However, BP’s engineers had noticed that if they used lower-salinity water, recovery factors seemed to increase.

Cockin’s research team at BP’s Sunbury-on-Thames facility decided to investigate and discovered that low-salinity water does indeed have some extremely useful properties.

The team’s chemical studies showed that the oil molecules are bound to clay particles in the reservoir by ‘bridges’ of divalent cations and in high-salinity water are compressed to the clay surface by electrical forces. By reducing the salinity, this force is reduced and the ‘bridges’ are able to expand allowing the divalent cations to be swapped for non-bridging monovalent ions freeing the oil molecules to be swept towards the producing wells.

At the heart of the technology is a giant 1,000-tonne desalination plant that will be placed onto one of the platforms

Following laboratory tests, the group trialled the technology at the Alaskan Endicott field, before deciding to roll it out at Clair Ridge. At the heart of the technology is a giant 1,000-tonne desalination plant that will be placed onto one of the platforms. ‘It’s not the sort of thing you can sneak onto a platform very easily,’ said Cockin, although he added that considering the advantages it brings its £125m price tag actually represents pretty good value.

Cockin added that another benefit of LoSal is that it actually helps to protect the reservoir. ‘It prevents souring of the oil and prevents scale problems because you’re not introducing anything,’ he said. ‘The water is filtered through reverse-osmosis membranes that take out viruses, nutrients, bacteria.’

The technique is thought to be suitable for the majority of sandstone reservoirs around the world and BP now has at least five new and retrofit projects under active evaluation. It estimates that use of low-salinity projects across its portfolio could increase net recovery by up to 700 million barrels of oil equivalent.

Back in the West of Shetland, another discovery which, like Clair, has had to wait for the technology to catch up is Total’s huge Laggan Tormore project, a development that will enable industry to tap into fresh gas reserves 125km to the northwest of Shetland.

The £3.3bn initiative — currently the largest offshore oil and gas project in Europe — involves the development of two gas and condensate fields estimated to hold around 240 million barrels of oil equivalent.

It’s on the same kind of scale as when BP developed the Forties or Shell the Brent in the 1970s

Jeremy Cutler, New Technology Developement, Total E&P

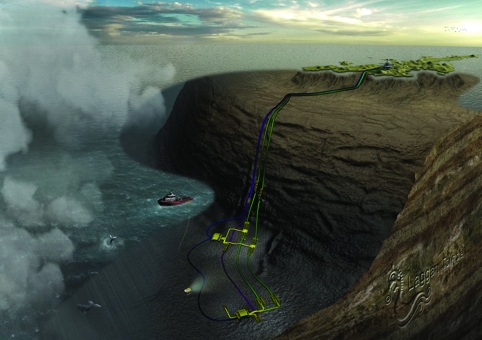

Twenty per cent owned by Denmark’s Dong Energy, the project is huge in both scale and ambition. It involves the construction of a new onshore processing plant on Shetland (adjacent to BP’s Sullom Voe terminal), the development of new subsea infrastructure and a 125km-long pipeline that, when complete, will represent the world’s second-longest tieback.

‘In terms of scale — the area it’s covering, the amount of people involved, the audacity of it and the new technology being evolved — it’s up there with the other major projects,’ said Total’s Jeremy Cutler. ‘It’s on the same kind of scale as when BP developed the Forties or Shell the Brent in the 1970s.’

Cutler explained that while Laggan has been ‘on the books’ for a number of years (it was actually discovered in 1986), it wasn’t until the 2007 discovery of the nearby Tormore field, the development of new technologies, as well as changes in the way that gas is sold, that the fields became feasible.

Until then, he said, the challenges of accessing what was regarded as ‘stranded gas’ were simply too extreme. ‘It’s in the deepest water that is currently being accessed in the UK — 600m — and in an area of extreme environmental conditions,’ said Cutler. ‘There’s very little export infrastructure for not just evacuating the products but processing them as well. We’ve had to start with a blank sheet of paper in that respect.’

Being so far away from the shore presented some significant challenges in terms of the design and installation of the subsea infrastructure. For instance, the 125km-long umbilical cable, which had to be installed in one piece to maintain signal strength and avoid the risk of leaks, had to be specially designed to keep within the 3,000-tonne limit of the carousel on the umbilical installation vessel.

The challenges on dry land are no less extreme with environmental regulations forcing the company to build a special facility to store and preserve the 650,000m3 of peat that was cut during the construction of the gas plant. Cutler said: ‘This is a world first… it’s effectively an enormous tank with a membrane that allows the water to drain through it.’

The project is now more than 80 per cent complete. The key elements of the subsea system are in place, drilling has begun and the gas plant is almost finished. Production from the facility is scheduled to start in summer 2014 and, at peak rate, the field is expected to produce 14 million cubic metres of gas and condensate per day.

With exploration continuing in the region and Total currently drilling an exploration well to the north east of Laggan Tormore, Cutler doesn’t rule out further discoveries in the vicinity. Indeed, he said that the capacity of infrastructure has been deliberately oversized with this in mind.

But while Laggan Tormore lies in the deepest UK waters accessed to date, a potentially even more challenging project lies further to northwest: Chevron’s Rosebank development, which will operate at a water depth of 1,100m.

The project — which also involves Statoil, OMV and Dong — is currently at the Front End Engineering and Design (FEED) stage but will ultimately include a floating production, storage and offloading vessel, production and water injection wells, subsea facilities, and a 147km gas export pipeline that will tie in to the SIRGE pipeline in the North Sea.

Discovered in 2004, the Rosebank field is estimated to contain total potentially recoverable oil-equivalent resources of 240 million barrels and has been at the forefront of the use of new advanced seismic imaging techniques (see box).

Despite the scale and ambition of the projects currently taking shape in the region, one gets an industry-wide sense that we’ve only just scratched the surface of the West of Shetland.

It’s the last remaining province we’re aware of and, on the world stage, it’s one of the harshest environments that we know. These are new play areas where there are still surprises to be had.

Jeremy Cutler

At the Clair field, BP is drilling at least five appraisal wells ahead of an anticipated third phase and, with the 28th licensing round due to be published in January 2014, activity in the region is expected is expected to continue to ramp up in the coming months and years.

For Total’s Cutler, the West of Shetland region represents the oil and gas industry at its most exciting. ‘It’s a very important area for the UK,’ he said. It’s the last-remaining province we’re aware of and, on the world stage, it’s one of the harshest environments that we know. These are new play areas where there are still surprises to be had.’

Oil and Gas UK’s Oonah Werngren agreed that there’s a real buzz about the region. ‘It’s the one area where today we can envisage that we’ll be producing hydrocarbons beyond 2050. We’re looking at newly discovered fields, we’re not talking about decommissioning in this area. We’re talking about new drilling, new discoveries and new infrastructure — it’s quite a different story.’

Advances in seismic imaging technology have been key to developing the West of Shetland

New developments in seismic imaging and seabed data-gathering technology have played a major role in industry’s quest to understand and unlock the geology in the West of Shetland region.

One of the most advanced techniques in the industry’s arsenal is Ocean Bottom Node (OBN) technology, which has been used by Chevron to evaluate its deepwater Rosebank project.

The technology involves using remotely operated vehicles to place individual sensors on the seafloor, as opposed to conventional technology, which uses sensors on streamers towed behind a vessel.

A better seismic image results from being able to deal better with echoes (‘multiples’) within the water layer by recording sound reflections from a wide range of directions (‘azimuths) and by providing a better measure of the speed of sound (‘seismic velocity’) in the rocks.

This is particularly useful in Rosebank as reservoir sandstones lie within volcanic layers that have a wide range of acoustic properties. According to Chevron, data acquired using this process gives a higher-resolution structural image of reservoir thickness and faulting, improves estimates of oil and gas in the reservoir, allows optimisation of well plans, and establishes a clear reference for any further seismic surveys to monitor production.

Nanogenerator consumes CO2 to generate electricity

Whoopee, they've solved how to keep a light on but not a lot else.