The report, Nuclear Power: A Future Pathway for the UK, assesses the state of nuclear policy in the wake of the announcement last week of more support for the development of small modular reactor (SMR) technologies. It identifies three immediate and urgent roadblocks to the progression of nuclear projects in Britain, and also calls for the government to embrace a much wider range of nuclear technologies than are currently deployed.

The pathway set out in the IMechE report rests upon three main objectives: replacement of all old nuclear capacity with new plants by 2030; building and deploying a fleet of SMR-based power stations by 2040; and developing Generation IV technologies (generally based on reactors that operate at much higher temperatures than current AGR and PWR plants) and fusion plants to come on-stream after 2050.

“The key challenge is to reduce costs and delays,” commented Dr Jenifer Baxter, IMechE's head of energy and environment.

The three roadblocks that the institution sees in the path of immediate progress are the issue of "Brexatom" – the UK's still-unresolved exit from the Euratom treaty as a consequence of leaving the European Union – which, the report says, would prevent the entire UK nuclear industry from functioning; the absence of a firm timetable and plan for the delivery of the long-mooted Deep Geological Disposal facility for high-level nuclear waste; and the fate of Britain's stockpile of plutonium, amounting to 112 tonnes.

Currently legally classified as waste, this is the world's largest stock of civil plutonium and is housed in a secure facility at Sellafield. However, plutonium contains huge amounts of energy and many believe that it should be regarded as potential fuel rather than waste to be stored and discarded.

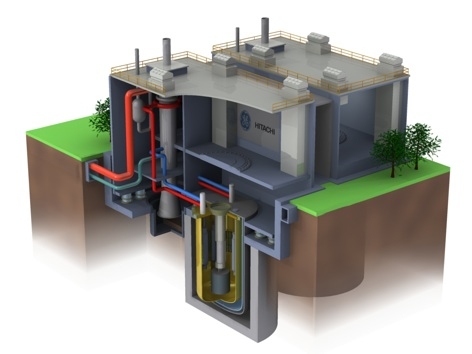

The IMechE recommends that the UK study the potential of PRISM reactors, a modified form of a liquid sodium-cooled breeder reactor developed by Hitachi but not yet deployed anywhere, for burning the stored plutonium, which would also be converted into a less radioactive form that would be safer and easier to store.

The report also calls on the government to implement an independent review of the Generic Design Assessment (GDA) process – the administrative procedure through which new designs of nuclear reactor are approved for deployment in the UK.

Administered by the Office of Nuclear Regulation (ONR), the GDA currently takes around five years to complete; until now, only two designs have been approved under this regime, the EPR design which is to be built at Hinkley Point C, and the AP1000, which is to be built at Moorside in Cumbria. Another design, the Chinese HPR1000 (also known as Hualong One), is now halfway through the procedure, ahead of planned deployment at Bradwell in Essex.

The review of GDA would ensure that unnecessary costs are not added to new reactors and will ensure that SMRs, when they are developed, can be approved faster, Baxter explained.

“SMRs present a lower cost option, with comparatively straightforward construction and, potentially, a more attractive investment proposition than conventional larger scale nuclear plants,” she said.

Among the other recommendations in the report are those to consider alternative funding options for developments at Wylfa on Anglesey and at Moorside; support for the development of a Modular Construction Plant on the Mersey estuary, to further support SMR projects; to make sure that the ONR has the required skills and capacity to assess SMR technologies; and to undertake a new Strategic Siting Assessment to identify potential locations for future nuclear plants.

“The delays and escalating costs of the Hinkley Point C project has provoked a public backlash in recent years against nuclear power. Yet as a reliable and relatively low carbon source of electricity, it makes sense for nuclear to form a greater part of the UK’s future energy mix, reducing our reliance on coal and gas,” Baxter said. “It is also vital that as the UK prepares to leave the European Union that nuclear construction skills are added to the shortage occupation list ― which would allow experienced workers from oversees to enter the UK.”

Meanwhile, the Department of Business, Energy and Industrial Strategy (BEIS) has issued a report on the implications of Brexit on the civil nuclear sector, which calls for a close relationship to be maintained between the UK and the Euratom treaty nations.

Baxter said that this would be an ideal scenario for the industry, as Euratom governs all movement of nuclear materials, as well as regulatory standards for nuclear installations and skills. The government's stated position is that, as Euratom comes under the jurisdiction of the European Court of Justice, the UK must leave the treaty when it leaves the EU.

Virgin Atlantic’s Flight100 saved 95 tonnes of CO2 in first SAF flight

LOL a time-honoured unit of volume measurement,, just as large <i>AREAS</i> are expressed as multiples of the size of Wales … or renewable energy...