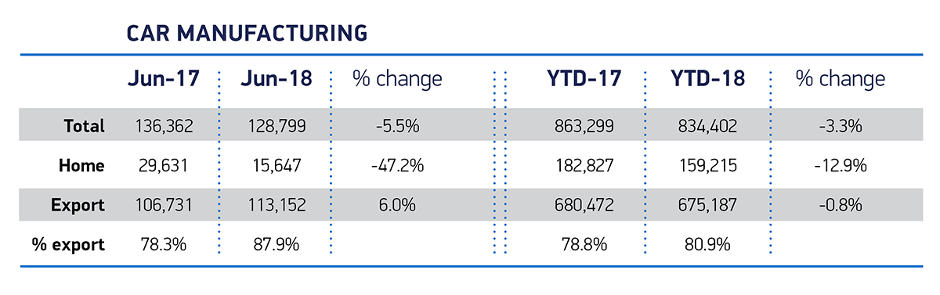

A six per cent growth in exports for the month is overshadowed by an overall 47.2 per cent decline in production for the UK. According to SMMT, model cycles, operational changes and preparation for a new range of next generation vehicle technology ahead of new WLTP (Worldwide Harmonised Light Vehicle Test Procedure) emissions standards, all contributed to June’s poor showing.

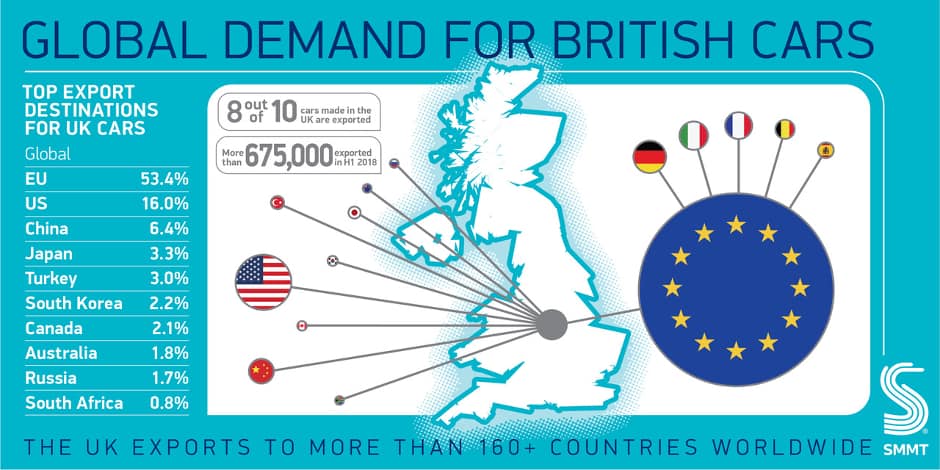

Exports continue to drive volumes throughout 2018, with overseas orders broadly stable, down 0.8 per cent in the first six months. In the year to date, 675,187 cars have been built for global markets and overall output down 3.3 per cent to 834,402 units.

In the six months to June, global demand for British-built cars grew in a number of key markets, notably the US – the UK’s second largest exports destination after the EU – where exports rose by 1.5 per cent thanks to new models.

Demand from Japan (+77.3 per cent) and South Korea (+67.8 per cent) was up, while China maintained its position as the UK’s third biggest customer, taking 6.4 per cent of exports.

SMMT chief executive, Mike Hawes said: “June’s results demonstrate the risks of judging automotive performance one month in isolation, with numerous and varied factors creating a perfect storm for home market output. Looking at the longer-term picture, the sector is performing as expected in the context of market conditions at home and abroad.

“First half figures are a reminder of the exports-led nature of UK Automotive, the integrated EU supply chain and our mutual dependency on free and frictionless trade. The UK government’s latest Brexit proposals are a step in the right direction to safeguard future growth, jobs and consumer choice – not just in Britain but right across Europe.”

Despite a -3.6 per cent decline in demand, the EU remained the UK’s biggest trading partner, accounting for 360,270 units, which is over half of all cars produced for export. Individually, EU countries also made up half of UK Automotive’s top 10 export destinations, with Germany, Italy and France the UK’s second, third and fourth biggest markets after the US and ahead of China.

Although UK Automotive now exports more than eight out of every 10 cars it builds to more than 160 countries worldwide, it is also a major importer. Over 87 per cent of the cars registered by British buyers in the first six months of the year came from overseas plants, and more than two thirds (69.1 per cent) from the EU.

Commenting on June 2018’s output figures, Stuart Apperley, director and head of UK Automotive at Lloyds Bank Commercial Banking, said: “The combination of rising sales across Europe and comparing June’s output figures with the same period last year should have meant these figures would look strong.

“The fact that they don’t, and have actually fallen even in comparison with a year ago, shows the extent of the challenges facing UK car manufacturers right now.

“Exports were strong but sales in the UK fell as continued pressure on consumer spending, together with only lukewarm words of support from government for diesel, weighed heavy on drivers’ appetites to invest in traditional combustion engines.

“Alternative powered vehicles performed better but are still too small a slice of the overall market to make a significant impact.

“Meanwhile, the speed of Brexit negotiations continues to leave businesses with little clarity of what the future holds.

“Manufacturers have shown recently that they are still willing to invest, and to prioritise the electric powered vehicles of the future. What they really need is greater clarity around the benefits of today’s cleaner engines, and around their ability to export in the years to come.”

Comment: The UK is closer to deindustrialisation than reindustrialisation

"..have been years in the making" and are embedded in the actors - thus making it difficult for UK industry to move on and develop and apply...