In the desert just outside of Reno, Nevada, stands a building that, seen from above, dominates the otherwise featureless landscape and – in terms of its footprint – dwarfs pretty much any other building on the planet.

This is Tesla’s Gigafactory 1, a vast lithium ion battery factory set up to satisfy the firm’s sky-rocketing domestic demand for electric vehicle (EV) batteries and, through economies of scale, fulfil its vision to bring affordable electric motoring to the masses.

When complete the facility is expected to have an annual battery production capacity of 150GWh per year, enough for 1.5 million cars. Add this impressive boast to the Tesla CEO’s famed knack for generating publicity, and it’s no surprise that the plant has attracted a fair amount of international attention. But Gigafactory1 is by no means the only show in town.

Indeed, around the world, in a bid to drive down costs and simplify supply chains, battery manufacturers and car makers are in a fevered race to establish similarly vast facilities to produce the cells, modules and packs that will power the EV revolution.

Whilst Asia remains the stronghold (China alone is projected to hit 800GWh of annual manufacturing capacity by 2025) Europe is expanding rapidly. Based on current plans - which include the construction of facilities in Germany, Sweden, Poland and Hungary - continental Europe will have 450GWh / year of production by the end of the decade.

But to the growing of concern of many in the UK, there are currently no firm plans for this country to follow suit: something of a surprise given its growing EV manufacturing base and historic expertise in the field (the lithium battery was invented in Oxford and the battery plant alongside Nissan’s Sunderland car factory was once the first of its kind in the Europe).

To give a sense of how rapidly things have moved on, whilst that same plant (now owned by Chinese firm Envision) remains the UK’s largest facility, its annual 2GWh capacity is dwarfed by the scale of the planned pipeline elsewhere in Europe. For example, Chinese firm CATL - one of the world’s largest providers of EV batteries - hopes to reach 60GWh at its main German site by the middle of the decade.

In a recent report, the UK’s Faraday Institution (a £78m initiative set up through the government’s £274m Faraday Challenge fund to drive developments in battery technology) warns that a failure to scale up could have disastrous consequences for the UK car industry. The fear is that as vehicle producers switch to producing greater volumes of electric vehicles, and wind down internal combustion engine production, the high cost of importing batteries (which can account for around 40 per cent of the value of an EV) will erode the commercial case for making cars here.

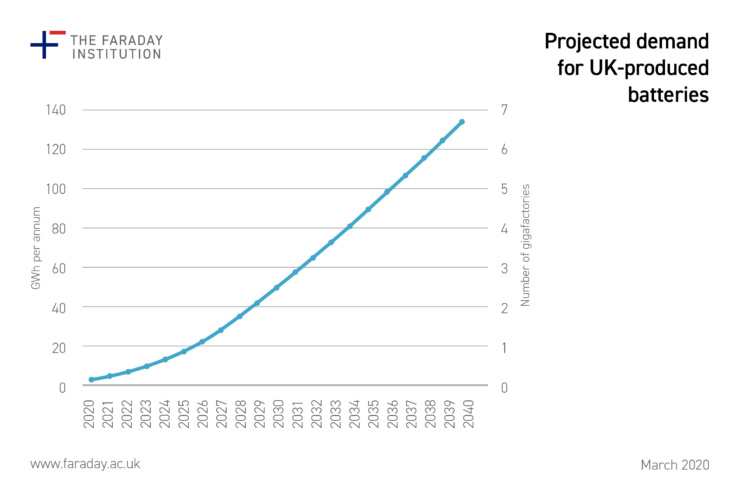

To avert this scenario, and tap into the huge opportunity presented by the UK’s growing EV market, the group claims that the UK will need to build at least seven 20GWh gigafactories by 2040. The question is: can it be done, and is there the political and industrial will to make it happen?

Faraday Institution CEO Neil Morris is relatively optimistic about the prospect, and told The Engineer that whilst the clock is definitely ticking, a combination of existing expertise and government support make the UK an attractive destination for battery investment.

Perhaps the most obvious of these attractions is the UK’s current position as Europe’s fourth largest vehicle manufacturer. And whilst failure to invest in battery scale up could see it drop down the rankings, Morris believes that the existing base is attractive to investors keen to tap into ready markets for their technology. “One of the key criteria battery manufacturers look to when placing a battery factory is proximity to car manufacturing,” he said. He added that the UK’s aforementioned historical pedigree - though in many senses an all too familiar tale of missed opportunities – is also a positive that has created a legacy of skilled workers and facilities that offer a strong platform to build on.

What’s more, whilst it may not yet have a Gigafactory the UK does have some existing and planned manufacturing capability. As well as the Sunderland Envision site, a new battery assembly centre at Jaguar Land Rover’s Hams Hall site, that will produce units for its next generation of electric vehicles, is expected to begin operation shortly.

There is also some interesting activity at the lower-volume end of the scale, perhaps most notably through HyperBat a joint venture between Unipart and Williams Advanced Engineering to manufacture batteries for high performance electric cars including Aston Martin’s Rapid E.

And it’s not all about automotive. Battery pack assembly specialist HyperDrive, which is based next door to the Envision ASEC factory in Sunderland, has enjoyed unprecedented growth by developing battery packs and battery management systems for customers including JCB and cherry-picker specialist Snorkel - a reminder that the opportunity for UK battery manufacturers is expanding all of the time. “We’re hanging on the coat-tails of the huge investment in automotive battery cells and we’ve engineered our product around those,” said Hyperdrive MD and founder Stephen Irish.

Perhaps surprisingly, the UK also has some of the key elements of the battery supply chain already in place in the form of some of the largest suppliers of materials for producing electrodes and electrolytes. “We have a chemicals industry in the UK that is potentially well set up to supply into a battery manufacturing industry,” said Morris. “They’ll need to invest and make slightly different products, but we already export graphite to China so that they can make batteries to sell back to us!” Pointing to a 2019 report commissioned by the Advanced Propulsion Centre and Innovate UK (Automotive Batteries - April 2019) he added that a scale up of UK battery manufacture would provide a major boost for this sector, potentially opening up £4.8bn per year market share.

Other less immediately obvious attractions include the UK’s relatively nimble approach to planning and infrastructure development - a key factor for ambitious Asian battery giants not used to too many obstacles ; and also the growing role of renewables in the energy mix. “There’s no point making loads of batteries from dirty coal fired power station in Poland,” he said. “It’s definitely on the mind of the battery manufacturers.”

Perhaps the biggest strength though, from Morris’ perspective, is the strength of the UK research base, and the degree to which different academic and industry groups are collaborating with each other. And the Faraday Institution, which was established to accelerate the commercial impact of this research base, is at the heart of this dynamic.

More on battery technology from The Engineer

FutureCat plugs into next generation of lithium-ion batteries

Lithium-ion battery pioneer wins 2019 Nobel prize in chemistry

Since being established in 2017, the body has launched nine major research programmes spanning 22 universities and involving multiple industry partners, any one of which, said Morris, could develop into a world leading battery technology company.

A number of these projects are focused on improving the performance of lithium-ion batteries. For instance, The University of Sheffield led FutureCat project, and the University of Bath’s CATMAT initiative are both at looking at ways of improving the cathode to get more energy into the battery. Another initiative, led by the University of Cambridge – is exploring the causes of battery degradation and failure in order to try to understand how to extend the life of batteries.

There are also a number of projects looking at different battery technologies. Researchers at St Andrews University, for instance, are exploring the potential of Sodium Ion batteries, whilst the Oxford led SOLBAT initiative is making major strides in solid state battery development – something of a holy grail for energy storage. “They are potentially much higher performance and much safer because they don’t have a flammable liquid electrolyte,” said Morris.

A further project, Nextrode, also led by Oxford, is looking at how battery performance could be enhanced by improvements in electrode manufacturing processes. “If we can improve the microstructure without changing any of the materials we might get significantly better performance and that means having significantly better control over the manufacturing,” he explained.

All of this activity, said Morris, is helping to build the UK’s profile on the world stage: “These projects are attracting interest from car and battery manufacturers. That tells me we’re doing something right, and it has the potential of attracting some of them to invest here. I know there is at least one battery manufacturer who sees having early access to having some of the technology we might develop as being a potential incentive to come here.”

Whilst the Faraday Institution is driving the development of new battery technologies, another Faraday Challenge funded initiative – the UK Battery Industrialisation Centre (UKBIC) - is exploring the challenges of taking these technologies into production.

From its 20,000 square metre facility close to Coventry airport, the £129m centre, which was grown out of work carried out at the Warwick Manufacturing Group (WMG), is aimed at both proving the manufacturability of emerging battery technologies and helping innovative battery companies take their technologies into production.

As former general manager of Nissan’s battery plant the new centre’s MD, Jeff Pratt, knows more than most about the challenges of manufacturing batteries at scale. And whilst UKBIC is on a much smaller scale than a gigafactory it does contain most of the technologies you would expect to find in one (see box out). What’s more, it is able to produce batteries at industrial rates. “The key for UKBIC is demonstrate that you can manufacture at a rate that is capable of being marketed” said Pratt. “You can develop a technology in the lab which looks very promising but if you can’t manufacture at that rate you can’t get it to market.”

Though NDAs prohibit him from naming them, Pratt confirmed that the centre already has a number of firms signed up who want to use the facility to produce cells to test and prove there’s a demand in the market before they invest further. He’s also hopeful that some of the larger battery manufacturers will outsource development work to the site. “As facilities become more utilised worldwide there’s less opportunity for them to develop a new project, take the line down and try something out.”

It’s clear that the joined-up nature of the UK battery ecosystem has created a fertile climate for innovation, and one which should be appealing to large battery firms.

But according to Pratt getting them to take the next step and invest is likely to require incentives of the kind seen elsewhere in Europe. Germany and France recently announced 1billion and 700 million euros of financial support, whilst Poland and Hungary have set up special economic zones offering tax relief to EV battery producers. “In September last year the government announced a £1bn fund to support getting the first Gigafactory on the ground , it now needs to flesh out what this means in practice and what form that support should take,” he said.

Getting the first factory over the line is the tricky bit. But once that’s in place Pratt believes there will be a snowball effect. “Once you set up the supply chain and have the first gigafactory – it’s relatively easy to expand that one or build others,” he said.

However, with this snowball effect already beginning to happen elsewhere in Europe, it’s becoming doubly the critical that the UK moves quickly. “There is a sense of urgency here,” said Morris, “We are falling further behind. A lot of capacity has been announced in Europe particularly in and around Germany and our government was probably a bit slower to announce incentives. There is no doubt that the uncertainty around Brexit last year and the distraction that that caused for the government means that we do need to pick up the pace.”

Failure to do so, he said, could lead to something of a doomsday scenario for the UK car industry. “If you’re importing all of the batteries to then export the vehicle – which is about 80 per cent of our car production – just from a supply perspective why would you import half the value of the vehicle? Why not just make the vehicle closer to where the market is? If the batteries are all being made somewhere else then maybe over time car production migrates to where the battery production is and you lose a lot of jobs.”

It’s an unsettling thought. But Morris is optimistic that there’s an appetite across government and industry to rise to the occasion. “EV manufacturers would very much like the UK to have battery manufacturing to support them making more EVs in the facilities they have here in the UK. And I think that government wants to secure the jobs, and secure a position in part of the energy mix of the future and to be a major player in battery production and battery technology development.”

Pratt is similarly upbeat about the UK’s prospects: “We definitely have the demand here. We’ve got some large OEMs such as Nissan in the north east and JLR in the midlands, and that’s just in automotive. Provided we make it attractive for companies to invest in the UK and bring the large-scale manufacturing here there isn’t any reason why we shouldn’t get our share of that future investment.”

Featured image credit: Ra2Studio via stock.adobe.com

How to build a lithium-ion battery

There are four distinct steps in the lithium-ion battery production process.

Electrode manufacturing

To form the electrodes precise doses of anode and cathode materials are mixed into a slurry with water and solvents which is carefully coated onto metallic foils to form the electrodes (copper for the anode, and aluminium for the cathode). These foils are dried in an oven and formed into a large roll in a “calendaring” process. This roll is then fed into a slitting machine where it is broken down into smaller rolls to make the electrodes required for the cells.

Cell assembly

This is where the anode and cathode materials are assembled into a single unit. Although there is a common set of fundamental steps, assembly processes vary depending on the type of cell that’s being made. The most widely used packaging style is the cylindrical cell – the familiar tubular cylinder - but there is a growing demand for pouch cells and prismatic cells which potentially take up less space and which require different assembly techniques.

Formation and ageing

One the cell has been assembled and the electrolyte added it’s time to set the cell chemistry. During this stage the cell is allowed to stand for period of time to let the electrolyte soak around it, before going through a number of charging and heating processes.

Module and pack assembly

Finally, it’s time to bundle up the cells for the end-customer. In this part of the process multiple cells are connected together to form a module, and modules are connected together to form a pack. For context, the 40kWh battery used in the latest version of Nissan Leaf uses 24 modules, each consisting of 8 cells.

Poll: Should the UK’s railways be renationalised?

The term innovation is bandied about in relation to rail almost as a mantra. Everything has to be innovative. There is precious little evidence of...