Bioresorbable material specialists raise £3.4m

A UK university spin-out targeting the US market with its bioresorbable material has raised £3.4m in a Series A investment.

4D Medicine, a spin-out from the Universities of Birmingham and Warwick, has been backed by Oshen Holdings, DSW Ventures, SFC Capital, Boundary Capital and private investors. It will enable 4D to complete pre-clinical testing of its first product range and seek FDA clearance for entry into the US market.

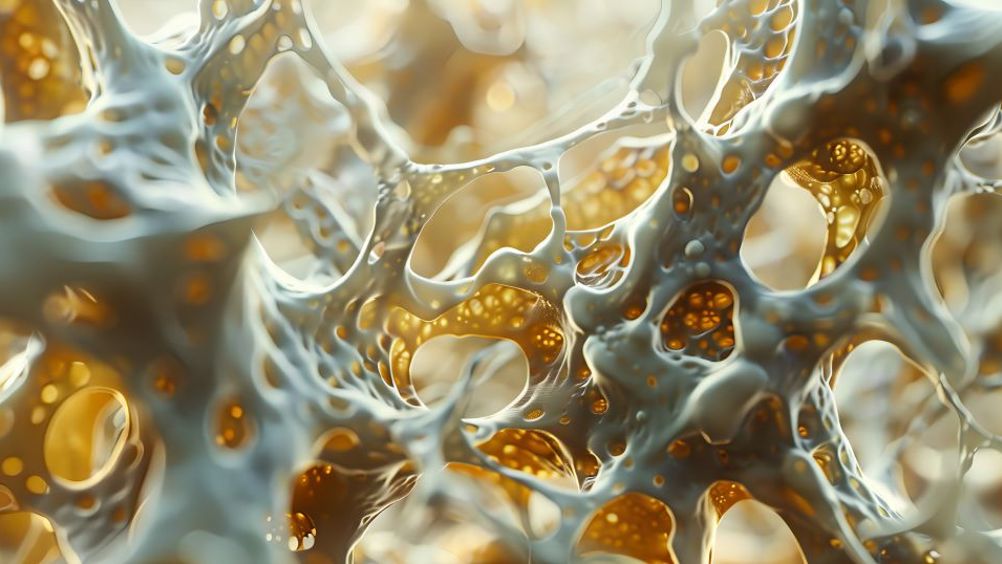

4D’s biomaterial is said to have the potential for use in a range of 3D printed implants and surgical devices.

In a statement, Doug Quinn, partner at DSW Ventures, said: “4D’s novel biomaterial platform opens up new possibilities for implants and devices. The company has already attracted attention from large industry players, including a potential acquirer. This funding will enable it to apply for regulatory clearance in the US and target opportunities in the £5bn market for resorbable medical devices.”

The company’s product - a photocurable resin called 4Degra - is a resorbable biomaterial being used to develop implants such as orthopaedic devices or soft tissue scaffolds to help patients recovering from surgery or injuries. Preliminary testing has shown that as healing progresses, the biomaterial gradually erodes and is resorbed by normal metabolic processes as natural tissue grows back in its place.

Register now to continue reading

Thanks for visiting The Engineer. You’ve now reached your monthly limit of news stories. Register for free to unlock unlimited access to all of our news coverage, as well as premium content including opinion, in-depth features and special reports.

Benefits of registering

-

In-depth insights and coverage of key emerging trends

-

Unrestricted access to special reports throughout the year

-

Daily technology news delivered straight to your inbox

UK Enters ‘Golden Age of Nuclear’

The delay (nearly 8 years) in getting approval for the Rolls-Royce SMR is most worrying. Signifies a torpid and expensive system that is quite onerous...