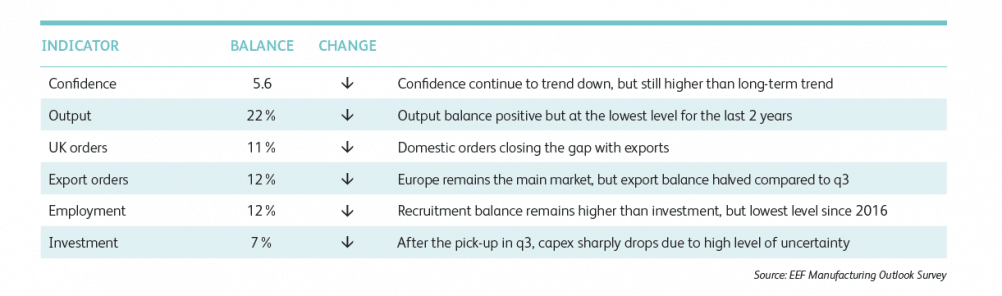

Produced in partnership with BDO, the survey covered 329 companies from 31 October to 21 November. Uncertainty over Brexit, combined with slowing global growth and a move towards protectionist trade policies, saw the export balance halve from Q3 to Q4 (+24% to +12%). Domestic demand fell less dramatically, slipping from +14% to +11%. According to EEF, anecdotal evidence suggests many companies are stockpiling inventory ahead of the UK’s departure from the EU, which may be artificially inflating the domestic figures. The Q4 collapse in international demand reflects the waning impact of sterling’s devaluation, along with wider global uncertainty.

“There are likely to be a number of causes for the fall in exports this quarter; uncertainty over our future relationship with the EU being the main one,” said Tom Lawton, head of Manufacturing at BDO. “In addition, more subdued global growth, the fading effects of sterling devaluation and the rise of protectionist policies appear to be starting to take their toll on growth.

“Overseas demand has helped sustain manufacturing growth over the last few years and the EU remains the most important trading bloc for UK manufacturers. It is crucial that Britain is seen to be open for business with the EU and other key global markets. The result of the ‘meaningful vote’ next week will dictate the government’s next steps and hopefully provide some much needed certainty as we enter the new year.”

As a result of the weaker overall picture, employment and investment indicators have dropped significantly. Both remain in positive territory, but recruitment intentions have slipped to +12% from +21%, whilst investment intentions have seen a sharp decrease from +20% to +7%. EEF said these figures are in line with official data for business investment, which is set to show a fall across 2018.

“The moderation in manufacturing performance over the course of this year appears to have gathered pace during the final quarter with more clouds on the horizon than there have been for some time,” said EEF chief executive, Stephen Phipson.

“This should come as no surprise given the significant political uncertainty at home which is why it is essential that there is an agreement for the UK’s withdrawal as soon as possible. If everything that can go right does, then business and consumer confidence should hopefully gather some steam next year with improved prospects for growth. That’s the backdrop we’re working to, let’s hope it’s the right one.”

The full report can be viewed here.

Poll: Should the UK’s railways be renationalised?

Rail passenger numbers declined from 1.27 million in 1946 to 735,000 in 1994 a fall of 42% over 49 years. In 2019 the last pre-Covid year the number...