Fleet market keeps UK auto sector on upward trajectory

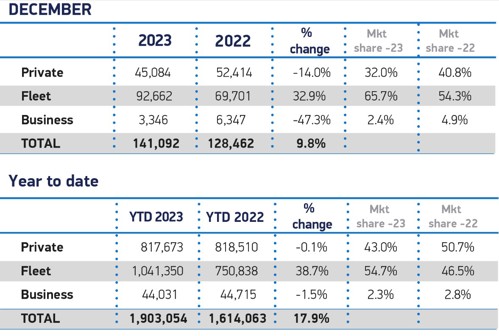

Britain’s new car market experienced its seventeenth month of consecutive growth in December 2023 with fleet investment boosting the market by 9.8 per cent compared to the same period in 2022.

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) show that in total, 1.903 million new cars reached the road during 2023, representing a year-on-year increase of 17.9 per cent.

Fleet deliveries rebounded by 38.7 per cent year-on-year, while business registrations fell by -1.5 per cent. Private consumer demand remained stable at 817,673 units (down 0.1 per cent compared to 2022) with SMMT identifying cost of living pressures and high interest rates as constraining growth.

While the overall new car market remains -17.7 per cent below pre-pandemic levels, the surge in uptake compared with the previous year saw the value of new car sales increase over £10bn to around £70bn, with 288,991 additional vehicles reaching the road.

Buyers continue to show a preference for superminis, dual purpose and lower medium cars, which accounted for 29.8 per cent, 28.6 per cent and 28.2 per cent of the market respectively.

Register now to continue reading

Thanks for visiting The Engineer. You’ve now reached your monthly limit of news stories. Register for free to unlock unlimited access to all of our news coverage, as well as premium content including opinion, in-depth features and special reports.

Benefits of registering

-

In-depth insights and coverage of key emerging trends

-

Unrestricted access to special reports throughout the year

-

Daily technology news delivered straight to your inbox

Water Sector Talent Exodus Could Cripple The Sector

Maybe if things are essential for the running of a country and we want to pay a fair price we should be running these utilities on a not for profit...