Last month, you may have read Josh Denne talking about how to bring new technology to the automotive market, and how we can help via the Advanced Propulsion Centre UK, APC, competitions. This month, I would like to build on that foundation and look at the next stage of success.

We are really good at innovation, and bringing technology to market in the UK, and over the last decade, there has been huge progress. At the APC alone we have supported more than 480 companies and institutions to deploy over £1.45 billion in investment. This should translate to greater than 400million tonnes of CO2 saved – however, these savings are only realised if the innovation is exploited at the required scale.

Often in early stage development, the scale of the technical challenge seems so great, it is really hard to look beyond it

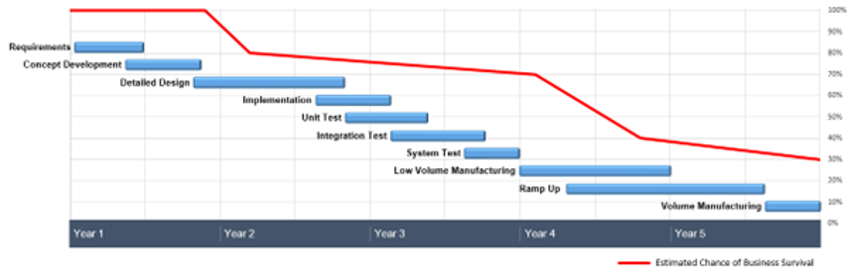

Scaling innovation into a successful business is hard – particularly manufacturing businesses. Almost counter intuitively, according to research by Fundsquire, more than 80% of businesses get through their first year, but as time goes on, the chance of success goes down, with around 60% of all businesses in the UK failing during their 3rd year. The annual data isn’t perfect, but from what is available, we can plot a rough estimate of this decline in businesses from Year 0.

It’s not a huge leap to overlay a standard (/optimistic) automotive product development timeline onto this and note that this inflection point lies after the stage where the product is complete, tested, and is being sold in low numbers, but before meaningful volume manufacturing is achieved.

Again, this seems counter-intuitive, as the hardest parts have been done by this stage, right? Surely a proven product, with proven manufacturing, and customers is the golden ticket – just make more to become successful. Sadly, all too often, this isn’t the case – but why?

Well, there are three key challenges that we often see become barriers for the business we work with, as they try to scale:

- A technically great product is not always scalable.

- Cost is a science, not an art form.

- Payment terms are a scaling business’ enemy.

These statements appear independent but are intrinsically linked. Often in early stage development, the scale of the technical challenge seems so great, it is really hard to look beyond it, and that is OK, providing you have a huge runway and can iterate your product multiple times – first making it work, then making in manufacturable, then making it cost effective - but the reality in today’s world is a ‘right first time’ approach is demanded because iterations are expensive and erode speed to market.

As such, simultaneous engineering is essential to achieve pace and a route to scale – that is building your supply chain and manufacturing process concurrently, and in partnership, with the design team. By involving your suppliers and manufacturing team in the actual design of the components, and product assembly, you front load the development cost, but can significantly reduce maturation loops and iteration, ultimately getting a manufacturable product released faster.

The second benefit of doing this is it gives greater control of cost. The cost of bought in components or materials is not something left to chance, or to a great negotiator, or worst, your supplier's whims, it is an engineering discipline, as important to scale-up as any other. Ensuring as a customer, you know exactly what everything you buy ‘should cost’, through modelling, is hugely powerful. Firstly, it means the engineers can make informed decisions about the design based on cost, and secondly, it means when negotiating pricing with supplier, every cost, from the raw material, through process, scrap, logistics to profits, is a known quantity. This is an even greater tool when the supplier has actively participated in the design activity, as you can agree these cost parameters and trade-offs during the development phase.

The final piece of this particular puzzle is how you pay for the well-priced components you have designed, because, the real bind comes when suppliers request up-front payment for parts (because as a growth business, there is little or no credit history), but customers demand +60 or +90 day terms after delivery, so often a business can find themselves having to bridge a chasm of at least 6 months between paying for their material to getting paid for their product. Using the process above can certainly help to mitigate this, as suppliers who have come on the journey are more likely to be supportive, but critically, this cannot be left to chance, or to the last minute – the cash flows during the scale-up phase need to be planned long in advance, and, it is essential to know what the art of the possible is – for example, buying tooling up front rather than amortising into the piece price will create a flexibility in minimum order quantities, and reduces supplier risk, or negotiating to pay for raw material up front, and the balance for the finished goods when they are ready to ship is realistic. There are many more options, but the goal is for everyone to win together, so it’s important to always consider the risks faced by the company on the other side and try to minimise that to get the best deal.

These are the types of challenges and hurdles we at the APC can assist with, we have a hugely experienced team, many from automotive engineering, procurement, manufacturing, and operations backgrounds, who alongside supporting companies to access grant funding, can provide significant value through coaching and mentoring to help UK innovators navigate to success.

More from the Advanced Propulsion Centre

- https://www.theengineer.co.uk/content/opinion/guest-blog-taking-technologies-to-market-in-the-uk-automotive-industry/

- https://www.theengineer.co.uk/content/opinion/blog-exciting-decade-ahead-as-uk-auto-sector-faces-up-to-climate-crisis

- https://www.theengineer.co.uk/content/opinion/guest-blog-dr-hadi-moztarzadeh-sets-out-a-roadmap-for-the-uk-battery-sector-2/

Water Sector Talent Exodus Could Cripple The Sector

Maybe if things are essential for the running of a country and we want to pay a fair price we should be running these utilities on a not for profit...