These are some of the findings from the latest Manufacturing Barometer which has found manufacturers slightly more optimistic about their prospects over the short and medium term.

Manufacturing SMEs call for clarity on government COVID-19 support

MORE COVID-19 ENGINEERING NEWS

Conducted by SWMAS (South West Manufacturing Advisory Service) and the Manufacturing Growth Programme (MGP), the report shows that 76% of firms saw sales drop in the last six months, with 48% predicting sales to decrease between now and the end of the year. Forty per cent are expecting a rise in future sales compared to the nine per cent who predicted this in April when the last Manufacturing Barometer was published.

According to the results, over a third of respondents describe their status as static or growing, with some businesses reporting very little change since the COVID-19 crisis, and others experiencing an increase in product demand. Over half (59%) of respondents describe their business’ status as “surviving” or “recovering”.

Although 80% of manufacturers have utilised the furlough scheme, over a quarter have made redundancies and 36% expect to make further cuts to their workforce within the next six months.

Just 32% of those surveyed have taken advantage of the Coronavirus Business Interruption Loan Scheme (CBILS) but results and feedback indicate that additional sector-specific government support is still required to ensure that manufacturing continues to recover and grow over the coming months.

The report is also said to show that protecting cashflow remains important as manufacturers move out of lockdown, with over a third of businesses surveyed expecting future investment in capex and staff to decrease between now and January 2021.

In a statement, Nick Golding, Managing Director at SWMAS, said: “Over 75% of businesses have had their sales significantly impacted, and only a small number have been able to access government support schemes to help them survive. The survey shows a picture of resilience and innovation from a sector that is doing its best to survive the COVID-19 crisis, but more still needs to be done to get it back on its feet.

“Whilst the figures represent an improvement from the previous quarter, it is clear that many SME manufacturers are still finding the current climate challenging. Nearly 80% of businesses have had to review cashflow forecasts to help mitigate the impact of COVID-19, whilst at the same time, a third are also coming under pressure from customers to extend payment terms, further stretching them financially.

“Our survey shows that manufacturers have been busy adapting their businesses as necessary over the last three months…That said, 38% of respondents indicated that some of their production is still on hold due to either customer or supplier closures, which will continue to impact them over the coming months. As a result, 41% have identified a need for financial and/or business support to help them identify new supply chains as part of their recovery strategy.”

Manufacturers were predicting a drastic drop in profits last quarter, with only 7% expecting an increase within six months. The latest findings show 33% expecting profits to grow in that same period. Despite this confidence from a segment of the market, 48% expect profits to fall further between now and 2021.

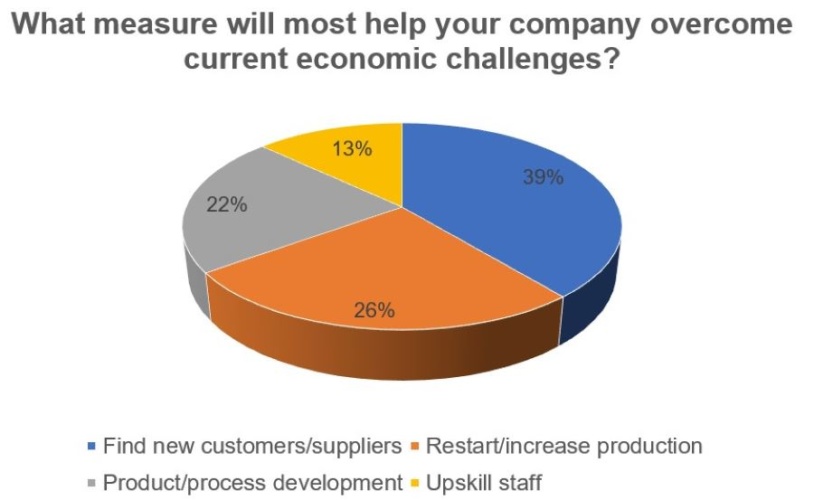

Given the findings of the latest Manufacturing Barometer, The Engineer asked readers to pinpoint the most important measure being taken at their company to get over the Covid crisis. The results are below.

Poll: Should the UK’s railways be renationalised?

I'm reminded of the old adage about stupidity is doing the same thing time and time again, expecting different results. The current model simply...