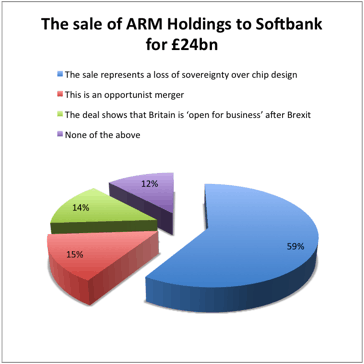

Last week’s Poll: the sale of ARM Holdings to Softbank for £24bn

Engineer readers are pessimistic about the implications of the sale of UK chip designer ARM Holdings to Japan's Softbank.

This poll elicited the most clear-cut conclusion for several weeks. Of the 509 respondents, a clear majority, 59 per cent, thought the acquisition of ARM represented a loss of sovereignty over chip design. Fifteen per cent thought it an opportunist merger (perhaps because of the post-referendum weakness of Sterling); while 14 per cent thought it showed the UK was 'open for business' despite opting for Brexit. The smallest group, 12 per cent, declined to pick an option.

Please continue to send us your opinions on this topic.

Register now to continue reading

Thanks for visiting The Engineer. You’ve now reached your monthly limit of news stories. Register for free to unlock unlimited access to all of our news coverage, as well as premium content including opinion, in-depth features and special reports.

Benefits of registering

-

In-depth insights and coverage of key emerging trends

-

Unrestricted access to special reports throughout the year

-

Daily technology news delivered straight to your inbox

Water Sector Talent Exodus Could Cripple The Sector

Maybe if things are essential for the running of a country and we want to pay a fair price we should be running these utilities on a not for profit...