The draft deal to limit climate change was signed off on Saturday and over the next five days politicians will attempt to translate it into workable agreement that is acceptable to the 195 parties in attendance at this session of COP21.

Whilst the politicians talk, companies are stepping forward with their contributions to climate change mitigation, with Philips stating it will be carbon neutral by 2020.

Philips says it has reduced its carbon footprint by 40% since 2007 but will address energy use over the next five years and aim to make carbon savings in areas that also include logistics and business travel.

The company believes it is making headway with membership of the RE100, a collaboration of businesses that seek to derive 100% of their electricity by renewable sources. In the years 2008 to 2014, Philips increased its use of renewable energy from 8% to 55%.

Schneider Electric has also stepped forward with a 10-point plan for sustainability aligned with its Planet & Society barometer, which has been measuring the company’s environmental performance for a number of years.

Schneider Electric has also stepped forward with a 10-point plan for sustainability aligned with its Planet & Society barometer, which has been measuring the company’s environmental performance for a number of years.

The overall plan at Schneider Electric is to achieve neutrality in its plants and sites and to build what it describes as a coherent industry ecosystem embarking suppliers and clients around two major contributions:

- Support and challenge partners to reduce their own energy consumption by 30 per cent through active energy efficiency solutions;

- Change lives of people at the base of the pyramid by giving them access to clean energy or by helping them to come out of fuel poverty.

Addressing COP21, Eric Rondolat, CEO, Philips Lighting, said: “As it stands, we’ve reached the climate change checkout and all the contributions from around the world have proved insufficient to prevent a potentially catastrophic rise in global temperatures.

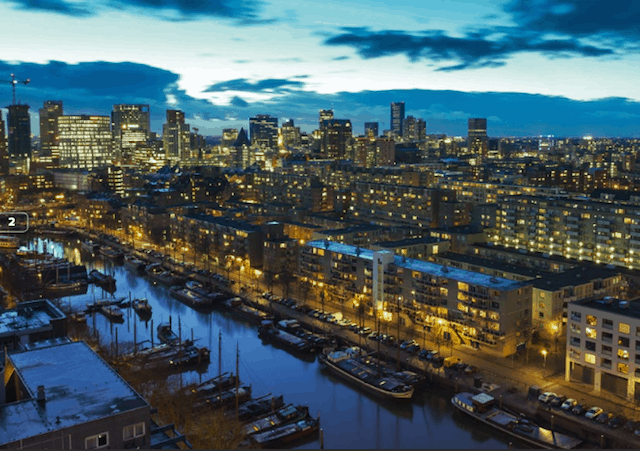

“The world must set more ambitious goals to improve energy efficiency. Faster adoption of LED lighting, and a drive to renovate existing city infrastructure and greater use of solar-powered LED lighting would have a huge impact.”

According to Philips, the Intended National Determined Contributions (INDCs) from countries participating at COP21 are predicted to contain global warming to between 2.7°C and 4°C by the end of the century, an improvement on the business-as-usual scenario of a 6.5°C rise but short of the globally agreed target of 2°C.

Philips add that the world could double the annual rate of energy efficiency improvement by using technologies already available and deliver half the emission reductions needed to meet the 2°C goal.

A certain degree of pessimism surrounds the next five days of talks, with doubts arising over the legally binding nature of all or part of the agreement and how nations – developed or otherwise – are defined in relation obligations that may arise.

Further pessimism abounds at EEF, which today published a report in conjunction with DLA Piper that indicates a difficult end to the year for Britain’s manufacturers.

EEF say: “Concerns about world trade growth and the weakening demand from developed and emerging markets have become more prominent, with a decline in export orders and rise in the proportion of companies unable to pinpoint any parts of the world experiencing an improvement in demand conditions. The domestic market is also looking considerably less supportive than has been the case in recent years, although some bright spots remain, in particular motor vehicles, aerospace and chemicals.”

Despite a wobble in October the automotive sector continues to put manufacturing on the economic map but increasing global instability and the slowing Chinese economy are posing threats to the sector.

This is the conclusion of Driving Innovation, a report published today from . The second report on the English and Welsh automotive manufacturing sector analyses the current state of the industry and the opportunities and challenges it faces.

According to Lloyds, the report sought views from across the automotive supply chain, and found that firms believe the global economy is the prevailing challenge to the industry, with 43 per cent of respondents citing it as their top worry for the second year running.

They add that the challenge is underlined by ‘a significant drop in the number of firms expecting to achieve business growth by entering new markets, falling from 68 per cent last year to 48 per cent this year. Given that 78 per cent of all vehicles made in the UK last year were exported, the results have heightened fears that the global slowdown will drag on the future performance of an industry that has substantially outperformed the broader manufacturing sector since the recession.’

Commenting on the EEF/DLA Piper report Lee Hopley, chief economist at EEF said the prospect of manufacturing contributing to growth in the UK economy in 2015 has all but faded away.

“The downbeat mood may not be universal across all industry sectors, but it certainly seems to be spreading as the challenges have mounted through this year – from the collapse in the oil price, slower world trade growth and weaker than expected construction activity,” she said in a statement. “The fact that this is contributing to manufacturers pulling back their employment and investment plans adds to the concerns about the sector going into next year. While the Chancellor’s recent Spending Review will have been seen as supportive to industry, it is critical that the government continues to act to ensure the UK is a competitive location for manufacturing.”

Key findings:

- Output balance falls for fourth quarter in a row, to lowest level since 2009q3. But steeper q-on-q drop seen in 2014q3 following oil price drop.

- Sector differences prevail – basic metals and electrical lead the falls, however automotive and chemicals still positive on output.

- Export picture deteriorates further with less optimism about European markets and almost 60% citing no improvement in demand in any main market.

- Domestic picture has also become less supportive – UK orders balance also records another negative quarter. And confidence about UK economic outlook in next 12 months takes a knock.

- Weaker results on output and order prompt first negative employment and investment balances since 2010q1.

- Manufacturing growth revised down this year to -0.1% and 0.8% next year

Source: EEF

Glasgow trial explores AR cues for autonomous road safety

They've ploughed into a few vulnerable road users in the past. Making that less likely will make it spectacularly easy to stop the traffic for...