As I write, George Osborne will be combing his hair, making sure his tie is symmetrical, deciding whether to sip on a whisky to drink during his speech (he usually doesn’t, preferring mineral water) and preparing to hoist his red box aloft on the steps of 11 Downing St for the traditional photocall before the last Budget speech of this government. Equally traditionally, he’ll probably have put some sweeteners into his speech to attract votes for the upcoming general election: maybe a few pennies off booze, a tweak to personal tax allowances or a nudge or two towards pensioners. We’re told that there’s not much cash in the coffers for big giveaways, but the Chancellor who can resist the urge to appear generous in exchange for votes is rare indeed.

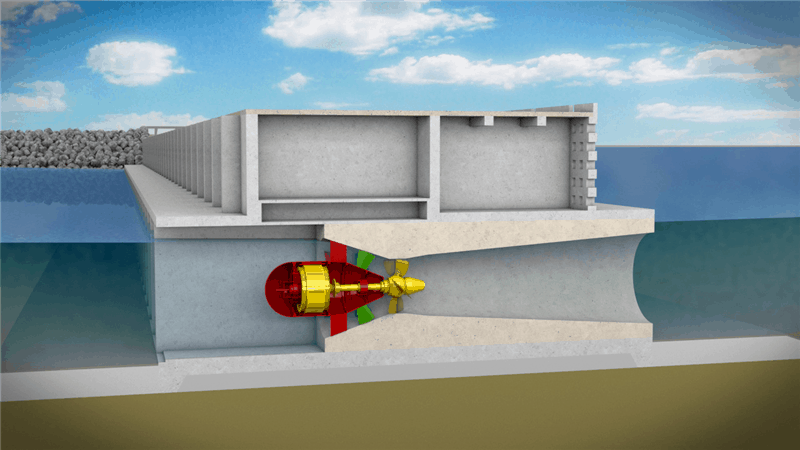

Two measures that we do know about are the opening of talks to fund projects to build an energy-generating tidal lagoon installation in Swansea Bay; and extended support for oil exploration in the North Sea. The Guardian reported last week that the government would enter negotiations with the Tidal Lagoon Power Company to agree a price for electricity produced from the proposed Swansea lagoon, in the same way as it agreed a price for nuclear energy with EDF to guarantee sufficient income to fund the building of new nuclear power stations. Tidal lagoon power is predicted to need an electricity price of £150 per MWhr to fund the £1bn cost of the project, which includes building a 9.5km long breakwater up to 20m high to cordon off 11.5km2 of the bay and install turbines in the wall to generate current on inflow and outflow. It’s a hugely complex and unprecedented engineering project, and the subject of divided opinions. Tidal Lagoon Energy’s experts will be answering Engineer readers’ questions on the technical challenges in the April issue of the magazine.

For the offshore hydrocarbon industry, meanwhile, the Chancellor is predicted to have devised measures to support exploration for new sources of oil and gas off the Scottish coast, which has declined dramatically as oil and gas prices rose. Initial measures were announced in last year’s Autumn Statement, with a cut in the supplementary tax on North Sea profits; an annonuncement of a further cut could come today, possibly along with further tax relief that could halve charges on some exploration schemes to 30 per cent. This is seen as necessary to safeguard jobs in the industry and to stave off concerns that hydrocarbon fields could be decommissioned prematurely, leading to serious knock-on effects that could make production unnecessarily difficult and costly in the coming decades, as we explained in the cover feature for our current issue.

Osborne is probably hoping that giving to conventional and renewable energy sectors at the same time should stave off accusations of favouritism to oil and gas, in conflict with the government’s stated goal of moving towards decarbonisation of the UK economy; or of throwing taxpayers’ money at expensive and impractical renewable schemes. But the climate over energy finances have been complicated yet again by a call for two of the world’s biggest charities to pull their investment in oil and gas, again from the Guardian.

The newspaper is requesting that the Bill and Melinda Gates and Wellcome Foundations divest themselves of all hydrocarbon industry holdings, while also calling on other investment funds to disinvest as part of a growing movement which has seen several universities and funds remove backing for carbon-intensive industries.

It’s a very thorny problem. The Guardian argues that both the Gates and Wellcome Foundations state that climate change is a major problem for society, while neither is a climate sceptic (that is, they agree that carbon emissions contribute to climate change) and that they therefore shouldn’t invest in the industry which enables carbon emissions generation. It’s a perfectly sound point, although not the sort of suggestion that makes one popular. Nobody enjoys being told that they’re a hypocrite, even if they are one.

But it doesn’t actually go anywhere towards solving any of the associated problems. It’s a fact that with current technologies and the way that the grid is set up, gas-fired power stations are a necessity. They are the only technology that is responsive enough to cope with variations in electricity demand. Pulling investment out of oil and gas won’t do anything to change that: oil companies don’t develop energy-generating technologies. It’s not easy to encourage that sort of development: the kind of speculative research which leads to these sort of breakthroughs (more responsive energy storage? Different types of nuclear power station?) are not the type which generates reliable income. That, of course, is why these investment funds operate at all: to make money that can then be used to fund medical and technological development to help vulnerable people. If they didn’t invest, their huge capital reserves would soon begin to dwindle and that wouldn’t help anyone.

So divestment could be seen as an ethical move in the right direction for these institutions, but it can’t make their job any easier. It just goes to show that when it comes to energy, there are no easy answers.

Poll: Should the UK’s railways be renationalised?

I think that a network inclusive of the vehicles on it would make sense. However it remains to be seen if there is any plan for it to be for the...