There’s no doubt that the decision by the $860 million Rockefeller Brothers Fund to reinvest its fossil fuel money in clean energy represents a pretty symbolic moment.

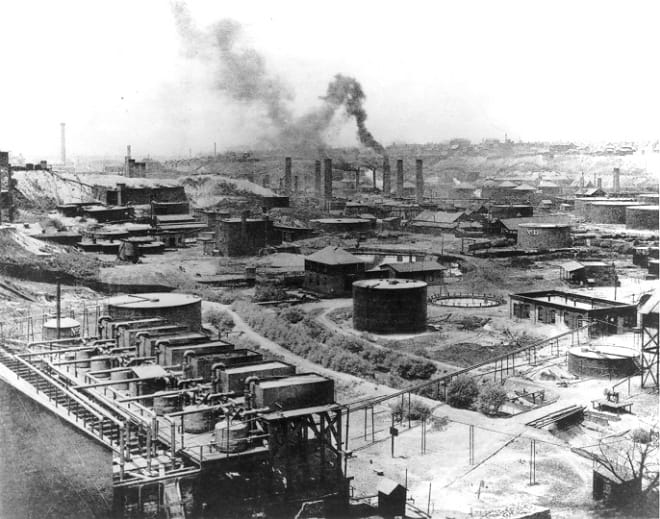

John D Rockefeller – who founded Standard Oil in 1870 – is one of the towering figures; some would argue the father, of the international oil industry. So the news that a charitable fund bearing his name is turning its back on the stuff that made the family fortune was always going to raise a few eyebrows. The fact that the announcement was timed to coincide with the current UN Climate change summit gave it extra punch.

Before we get carried away it’s worth stressing that the announcement is perhaps not quite as dramatic as some have claimed.

Indeed, whilst the tone of some headlines might imply that the Rockefeller family’s entire oil wealth is being sunk into renewables, the reality is more low-key. The Rockefeller Brothers Fund is one of a number of charitable funds – such as the much larger $1bn Rockefeller Foundation - all of which have heavy investments in the oil industry. And as yet, there’s no indication that these other funds are likely to follow suit.

Nevertheless, the decision is significant as well as symbolic.

The Rockefeller Brothers Fund is now the most high profile convert to “divest-invest”, a global initiative which began life on US university campuses around a decade ago and claims to have persuaded over 181 institutions to redirect $50bn of oil investments into clean energy.

For many, the goals of the movement will no-doubt be seen as fluffy and idealistic. And some will undoubtedly argue that any investors following this path have been duped, and are putting misplaced ethical concerns ahead of economic common sense.

But whilst most of those signing up to “Divest-invest” will be motivated by ethical concerns, the appearance of the Rockefeller name reinforces a growing perception that hard-nosed economics is playing a role here too.

In his landmark 2006 report – Nicholas Stern, one of the most influential voices on climate change - argued that concern for the climate and economically sustainable energy policies were, far from being mutually exclusive, actually deeply entwined. Could the blossoming interest in initiatives such as divest-invest be evidence of this phenomenon in action?

What’s more, even if you disregard concerns over climate change it’s certainly arguable that thanks to a combination of geology, geography and geopolitics the economics of fossil fuel extraction are becoming less attractive.

Perhaps it’s no real surprise that one of oil’s oldest families should be looking elsewhere for a return on its investment.

Poll: Should the UK’s railways be renationalised?

Rail passenger numbers declined from 1.27 million in 1946 to 735,000 in 1994 a fall of 42% over 49 years. In 2019 the last pre-Covid year the number...