But with some of the world’s most dynamic emerging economies keen to become less reliant on imports and the uncertain global economic climate driving “big-pharma” to eye-up new markets, many believe that the shape of the industry could change significantly in the years ahead.

Against this backdrop, the emerging field of “modular pharmaceutical manufacturing”, which enables the rapid and relatively low-cost off-site construction of pharmaceutical plants, is thought to be particularly promising.

A number of companies are exploring the concept. In US, Biologics Modular and Modular Partners both design bespoke modular facilities, whilst Swedish company Pharmadule has already developed biomanufacturing suites for a range of life science companies.

However, the latest entrant to this emerging field, GE Healthcare, claims that its recently launched Kubio concept, takes the technology to a whole new level.

Jointly developed with German engineering and construction firm M&W Group, and launched late last year, Kubio is a modular biopharmaceutical plant chiefly aimed at the production of vaccines and monoclonal antibodies; targeted drugs which are increasingly being used to treat a range of conditions including cancer, rheumatoid arthritis and crohns disease.

Olivier Loeillot, who heads up GE Healthcare’s enterprise solutions division told The Engineer that by bringing together two of the world’s biggest hitters in their respective fields, the technology marries construction and process expertise in a way that few competing systems have managed so far.

It’s so much easier than appointing a local construction firm that may not have a clue about how to build a pharmaceutical manufacturing plantOlivier Loeillot, GE Healthcare

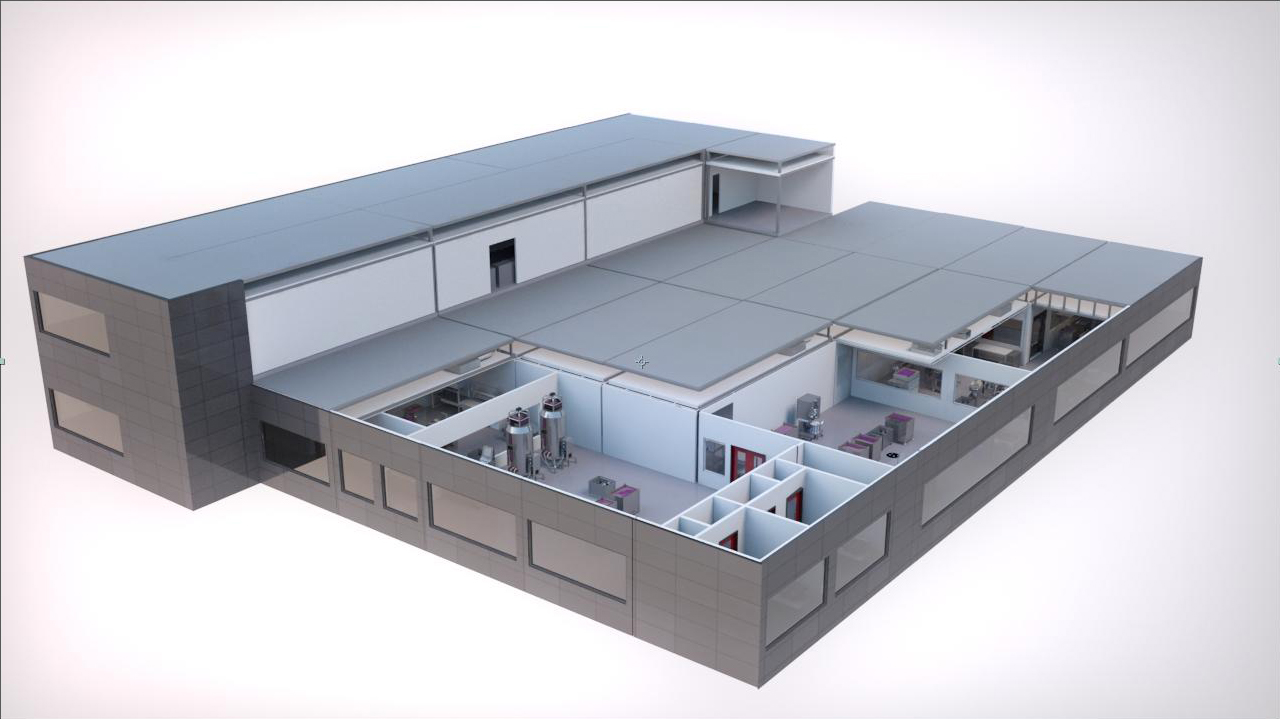

Occupying a footprint of around 1200m2, made up of between 40 to 50 separate modules, and taking between 14 - 18 months to plan, design and build, Kubio is pre-fabricated off-site and delivered with a complete ready-to-use production line based on GE’s so-called Ready-to-Process, disposable technology.

Loeillot explained that developing the plants with M&W group has delivered a number of significant advantages. Not least the fact that the company already has considerable expertise building plants for the life-science and chemical industries. ‘It’s so much easier than appointing a local construction firm that may not have a clue about how to build a pharmaceutical manufacturing plant,’ he said.

But equally importantly, while building a new pharmaceutical plant typically involves a rather laborious planning process, the off-site approach enables the engineers to begin work on the project before the paperwork’s finished. ‘If you’re dealing with a country where you may not have a relationship with all the key decision makers it can often take up to six months to get a permit to operate in the country,’ said Loeillot, ‘With Kubio you can start building your plant – because the first six months of your activity are happening only in Germany.’

Within the plant all of the equipment that will come into contact with the product is made from plastic components that are thrown away and replaced at the end of a production run. Much of GE’s expertise in this area derives from its acquisition, earlier last year, of US firm Xcellerex, which specializes in the development of biomanufacturing systems based around single-use components.

Though effectively throwing away process equipment after one use may sound somewhat unsustainable, Loeillot explained that disposable technology has a number of major advantages and is fast becoming the preferred option for biopharmaceutical production. ‘There is a real shift in the industry from stainless steel to disposable technology. You avoid cleaning and cross contamination and it also offers you flexibility. In a typical stainless steel plant between one product and another you need about 2 weeks of cleaning, which means 2 weeks where you cant can’t be manufacturing. Replacing weeks of changeover with only a few days has a huge financial value for a company.’

While the Kubio concept sounds pretty radical, Loeillot is keen to stress that it shouldn’t be viewed as a complete departure from traditional, tried-and-tested techniques. ‘The way we design it is very traditional as far as the personnel flows and material flows are concerned,’ he said. ‘We want a concept that has already been approved by the FDA and the authorities so that our customers know they are going to get a plant that has all of the features that the other plants in US and Europe have.’

Although GE is yet to announce its first Kubio customer, Loeilliot confirmed that it’s now in advanced discussions with a number of companies and hopes to be able to announced its first deal within the next few months. And though some commentators have suggested that “big-pharma” may feel threatened by a concept that could ultimately undermine its export market, he claimed that industry is instead excited by a technology that could help it find a route into new markets.

‘Big pharma has shown a huge interest,’ said Loeillot. ‘They realise that they face a very significant slowing in market conditions and that in order to maximise the chances of them being successful they need to go for a solution that they are going to be able to replicate from one country to another, something that’s going to be fast and easy to implement even in a country that may not have any know-how in engineering and drug manufacture.’

Perhaps most importantly though, the technology could present emerging economies - countries like Turkey or Mexico - with a straightforward way of developing their own manufacturing base, potentially helping to reduce the cost, and improve the availability of life-saving drugs.

In the medium term Loeillot and his team believe that Kubio has the potential to provide an intriguing new dimension to the global pharmaceutical industry.

Longer term, however, the technology could drive an even more significant change in the way that drugs are produced.

One area that particularly excites Loeillot is cell therapy, where, for instance, treatments for cancer are developed using a patient’s own cells. ‘In the next 10 or 20 years, I can see that whenever you have to develop a specific treatment for each person you will need very small type of facilities – you can imagine you’re not requiring 40 or 50 modules, but one or two modules only where you could run a very small type of manufacturing. Maybe one day any hospital with, for instance, a very big focus on oncology, could potentially end up having one of these facilities next to the hospital to produce these treatments.’

Glasgow trial explores AR cues for autonomous road safety

They've ploughed into a few vulnerable road users in the past. Making that less likely will make it spectacularly easy to stop the traffic for...